As we start another year, real properties, including land and improvements like buildings, machineries and equipment, whether permanently or temporarily attached to the land, are again levied with real estate property tax (REPT).

This tax, commonly referred to as amilyar in the vernacular, covers residential, commercial, agricultural, industrial, special, i.e., educational, cultural, scientific and institutional facilities, timber and mineral lands, among others.

Although the assessment level (AL) varies with the property’s land classification, the improvement is assessed on cost, either on acquisition, replacement or reproduction, while machinery is based on purchase price, less depreciation.

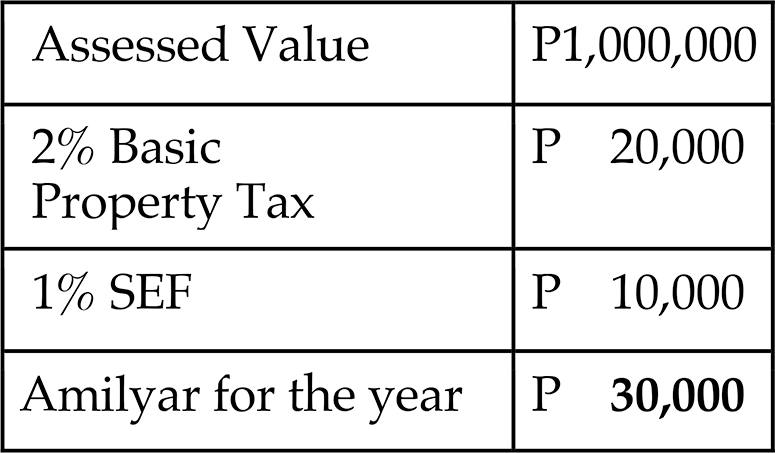

To determine the assessed value (AV) of the property, the fair market value – for example P5 million – is multiplied by residential AL of 20 percent to get the AV of P1 million.

Based on the AV, Local Government Units (LGUs) peg their own basic property rate. Pursuant to the Local Government Code of 1991, Metro Manila cities and municipalities are allowed a basic property rate not to exceed two percent of the AV while provinces are allowed a rate not to exceed one percent. In addition, LGUs are allowed to charge an extra one percent tax for Special Education Fund (SEF).

To illustrate:

While the amilyar actually accrues every January 1, payments may be made before or after the said date, although four equal quarterly installment payments within the year is the norm.

Huge discounts

To entice owners to pay early, LGUs use different discount promos, such as “advance payment” and “prompt payment”.

Shown below are sample discounts given by Metro Manila LGUs for the year 2024.

Manila City. Payments made in full before December 10, 2023 will be entitled to 20 percent advance payment discount, while payment made between December 11 to 29, 2023 will be entitled 15 percent advance payment discount. Full payment made during the whole month of January 2024 will have a lower 10 percent prompt payment discount.

Quezon City. Payments made in full before December 31, 2023 will be entitled to 20 percent advance payment discount while full payment made from January 1, 2024 to March 31, 2024 will be entitled to a reduced 10 percent prompt payment discount.

Taguig City. Real property tax payment made in full before December 29, 2023 will get a 20 percent.

Pasig City. Payments made in full before January 1, 2024 will be entitled to 15 percent advance payment discount, while full payment to be made not later than January 31, 2024 will be given 10 percent prompt payment discount. Payments made on or before the end of each quarter’s installment due date (March 31, June 30, September 30 and December 31) will be given a five percent quarterly payment discount.

Makati City. Payment made in full before January 20, 2024 will be entitled to 10 percent payment discount.

Consult your LGUs now

Since local government units are allowed to enact their own discount rates vis-a-vis payment schedules, it is best to immediately contact them early to maximize your savings.

* * *

Henry L. Yap is an Architect and Fellow of both Environmental Planning and Real Estate Management. He is one of the Undersecretaries of the Department of Human Settlements and Urban Development.