Buying property entails making a major decision. For many first-time investors, paying cash is often on top of their minds, unless they lack the financial capacity to do so. Afraid of incurring debt early on, buyers question the need to borrow, when, in fact, they have the means to shoulder the full cost of the planned acquisition.

Unfortunately, it is a life-changing event that may eat up your reserves. As such, if you wish to have ample funds to manage your business’ regular expenses, you need to think through and decide carefully how you should pay for it.

Finance your purchase

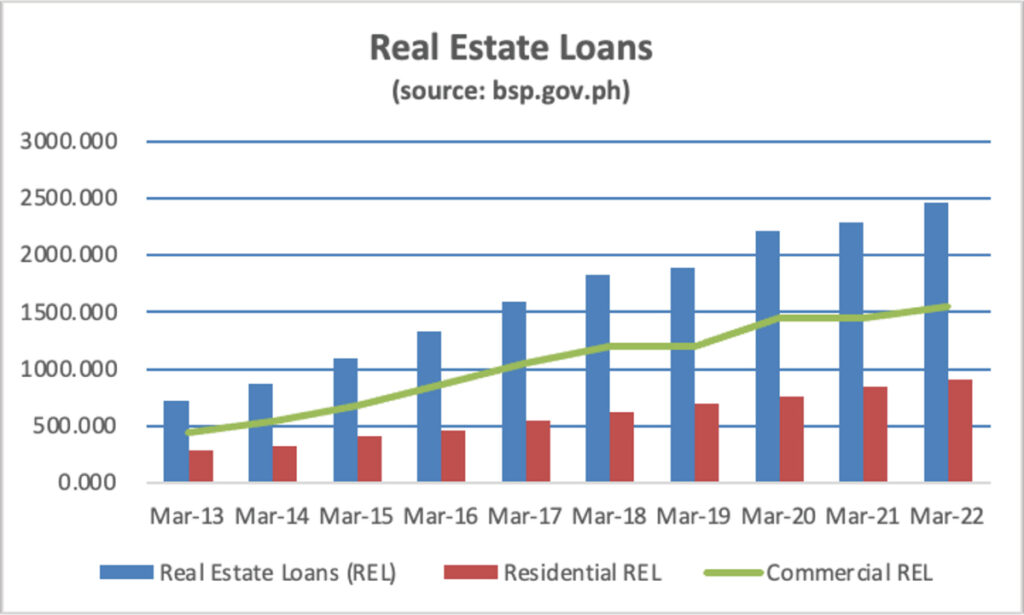

A lot of Filipinos actually borrow money to finance their property purchase. Bangko Sentral ng Pilipinas’ data of the bank proper plus trust department’s March 2022 residential real estate loans (REL) amounted to P908.655 billion while commercial REL accounted for P1,552.252 billion, for a combined REL of P2.461 trillion. The 36.92 percent share in residential REL reflected an increase of eight percent in absolute value, year-on-year, and a 19.4 percent jump from the start of the pandemic lockdown last March 2020.

However, with the Monetary Board’s recent decision to raise the BSP’s key policy rates to help address inflation and the weakening peso, interest on overnight deposit and lending facilities are expected to increase so property buyers who intend to borrow should consider doing it early.

Of late, interest rates given by universal and commercial banks to buyers of their preferred developers range from five to eight percent for one-year to five-year fixed period, with repricing rates between 6.25 percent and 10 percent. A one percent rate adjustment per P1,000,000 loanable amount payable over five years will result in additional interest of approximately P25,500.

Borrowings do entail cost, but the lost opportunity of spending cash for other essentials or business requirements should not be overlooked. Seasoned businessmen know that “cash is king” and maintaining liquidity allows them to undertake other investments.

Entrepreneurs know how to make others’ money work for them. It comes as no surprise that they borrow to grow their ventures and wealth. As Robert Kiyosaki wrote in his article titled 3 Tips for Getting Started in Real Estate (richdad.com).

“If you’re investing for cash flow, the market’s direction is no longer important, nor do you need to worry about liquidity. Your goal is to collect monthly rent for profit—and any gain in value of the property itself is a bonus”.

Cons

Yes, paying cash can save money as it reduces the probability to overspend beyond your means, eliminates impulse purchases, and encourages more prudent budgeting.

So, before deciding on which payment mode to use, calculate the cost and determine your payment capacity. Every person’s situation is different. Do what you are comfortable with, without sacrificing your goals and aspirations.

* * *

Henry L. Yap is an architect, environmental planner, real estate practitioner and former senior lecturer.