(Second of two parts)

Integrate township components into industrial parks

Colliers recommends that developers assess the viability of incorporating industrial parks inside township developments. In our view, industrial parks and warehouses are alternative options to traditional offices in live-work-play communities. For instance, AboitizLand’s LIMA Estate is composed of an industrial park, LIMA Technology Center, and a residential subdivision, The Villages at Lipa. The township will also feature hotels, dormitories and commercial areas. Other industrial parks located inside integrated communities include Pueblo de Oro’s Light Industry and Science Park IV in The Townscapes Malvar in Batangas and Filinvest Land’s Filinvest Innovation Park in Ciudad de Calamba in Laguna.

Southern and Central Luzon corner new locators

In H1 2023, industrial vacancy in the Cavite-Laguna-Batangas (CALABA) industrial corridor dropped to 5.5 percent from 5.7 percent in H2 2022. Industrial take-up during the period was supported by logistics firms, as well as food, electronics and equipment manufacturing firms. An FMCG retailer also took up industrial space in Cavite Technopark.

In Q1 2023, approved foreign investments in the CALABARZON region reached P47.5 billion ($863.6 million), accounting for 28 percent of total approved investments during the period.

According to the Philippine Chamber of Commerce and Industry (PCCI), the region is touted to receive more investments because of its “robust industrial and manufacturing sector for automotive, electronics, textiles and food processing.”

Some of the recent locators which announced expansion in CALABA include Procter & Gamble (P&G) which will expand its current site in Light Industry and Science Park 1 (LISP 1) with a new diaper manufacturing facility, as well as Dyson which will build a research and development (R&D) facility within First Philippine Industrial Park (FPIP).

Meanwhile, D&L Industries opened its new factory in First Industrial Township in Batangas which will manufacture food ingredients, plastics and chemicals.

Going electric

Colliers is also seeing sustained interest from electric vehicle (EV) firms. Ayala Group recently partnered with US-based Zero Motorcycles for the production of EVs within Laguna Technopark.

We see Central Luzon rising as a viable alternative industrial location. Among the firms that recently announced expansion in the region include Shera Building Solutions in Teco Industrial Park in Pampanga, Envirotech in Clark Freeport Zone and StBattalion in New Clark City.

In our view, the modernization of the Clark International Airport and the completion of the proposed Subic-Clark Cargo Railway will likely support the expansion of industrial activities in Central Luzon. The latter should further propel the region’s attractiveness as a manufacturing hub.

Both infrastructure projects will be complementing each other and will be particularly crucial in fulfilling deliveries of semiconductors and other merchandise exports.

Credit where credit is due

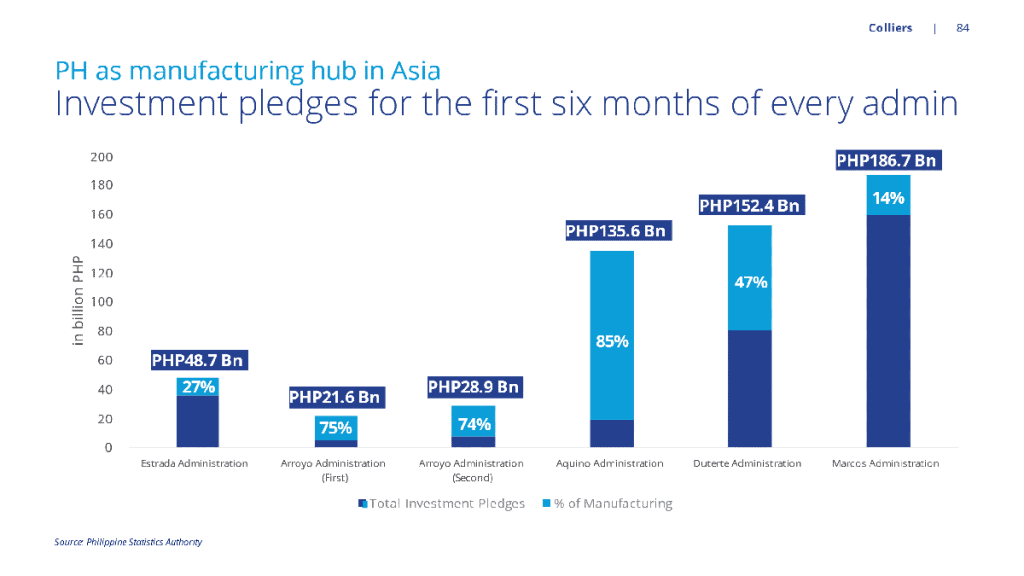

The Marcos administration received record-high investments from January to June of 2023 and officials of the country’s investment promotion agencies should be lauded for this. But the next major hurdle is how to ensure that these committed investments become actual foreign investments and contribute to greater absorption for the industrial space and warehouses across the Philippines.

In our opinion, a proactive stance in providing concessions will also enable industrial parks to corner more investments from the Philippines’ traditional and non-traditional sources of foreign investments. —With Brent Christian Respicio

Image by Freepik