The retail sector has been growing steadily after the Philippine government lifted mobility restrictions across the country.

Mall operators and retailers are reporting rebounding consumer traffic and some even note that revenues are even stronger compared to pre-pandemic levels.

The retail sector is one of the most dynamic segments of the property sector and we see it continuously outperforming other segments as malls serve as Filipinos’ de facto public spaces.

Colliers also believes that the entry of more foreign retailers will make the mall scene more dynamic, exciting, and competitive.

Holiday spending stoked the country’s retail segment in the fourth quarter of 2022. An upside for the sector is that Filipinos continue to spend even after the festive season and despite elevated prices, although inflation is starting to cool down at least for the first four months of 2023.

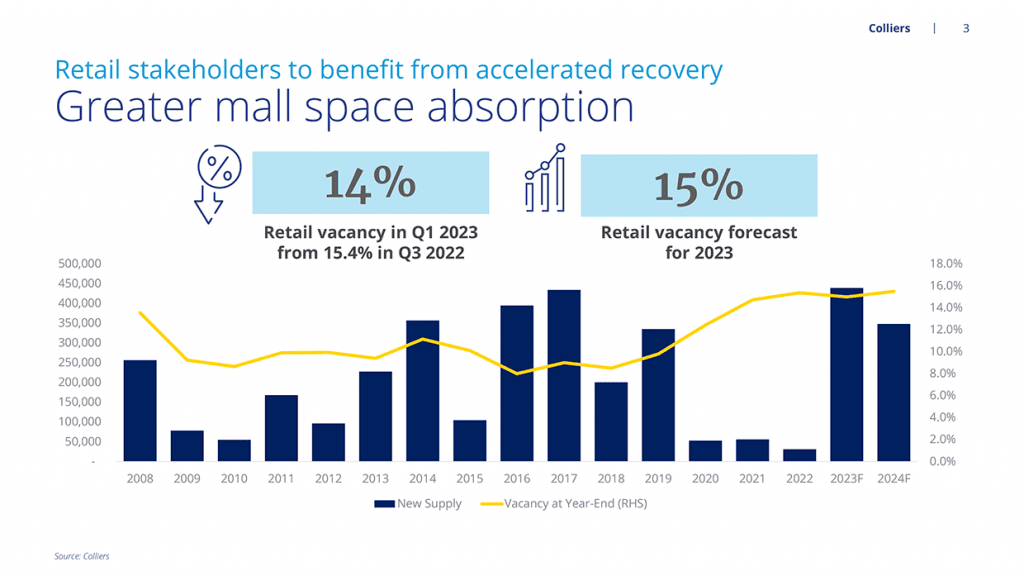

Colliers believes that the retail sector will continue to grow for the remainder of the year, resulting in greater absorption of mall space and marginal rise in lease rates.

However, the delivery of substantial new supply starting in the second half of 2023 will be a major concern, as this will likely raise vacancy rates across Metro Manila and as more operators compete for retailers.

Lock in space in prime locations

Lease rates are starting to increase that’s why retailers should be quick in locking in prime spaces in major business districts.

In our view, this trend is likely to persist in the market as footfall is rebounding across the capital region.

We still see substantial vacancies in selected malls in Quezon City, Bay Area, and Alabang and retailers should further explore the viability of opening physical space in these locations.

Online and offline shopping will continue to complement each other, which should compel mall operators and retailers to ramp up their omnichannel strategies.

Colliers believes that retailers should be quick in securing mall spaces in key business districts across Metro Manila now that vacancy rates are declining while rents are gradually increasing.

We see heightened competition for prime retail space especially in key business districts that will house new and expansive office and residential towers.

Seize the demand from foreign retailers entering the Philippine market

Colliers sees an improving demand for physical space from foreign retailers. We attribute this to improving consumer demand on the back of sustained macroeconomic expansion and to the enactment of measures which further relax the country’s retail regulatory environment.

Mall operators should capture demand from foreign retailers planning to enter the country by taking into account their size and fit-out requirements.

Mall space take-up picks up

In the first quarter of 2023, vacancy across malls in the capital region dropped to 14 percent from 15.4 percent in the third quarter of 2022.

Major developers have reported that consumer traffic has now reverted to 90 to 100 percent of pre-COVID-19 levels.

Because of rising purchasing power due to improving consumer confidence and personal income tax cuts implemented by the government, retailers have been active in taking up physical mall space.

Colliers believes that while online shopping will remain relevant among Filipino consumers (especially among young shoppers), in-store shopping will continue to rebound, as shown by relentless absorption of physical mall space within Metro Manila.

Sound macroeconomic fundamentals are likely to support the retail sector’s growth over the next 12 months.

The reactivation of high-density retail, staging of various events at malls’ activity centers, and renewed interest in experiential retail should also entice more Filipinos to visit malls and further stoke spending.