Environmental, social & governance or ESG factors have become important considerations for real estate shareholders in their decision-making process, Santos Knight Frank (SKF) said in a press conference last month.

ESG is a framework that helps stakeholders understand how an organization is managing risks and opportunities related to environmental, social, and governance criteria.

In recent decades, investors have been closely looking for ESG in companies. SKF, the property consultancy firm, said it’s no different for investors or stakeholders in real estate.

Those investing in property companies or those who are buying property have put primary importance on ESG.

The benefits of ESG reporting include having the ability to identify and manage risks and opportunities related to environmental and social impact and building a relationship of trust and transparency with investors and stakeholders.

More importantly, ESG reporting also attracts more sustainable investors.

Thus, in the case of the real estate industry, ESG helps attract investors to different real estate assets and the companies behind these different property sectors.

Green leasing

Another emerging trend is that landlords and occupiers will need to work together to achieve ESG and Net Zero targets. Trends such as green leasing are already emerging in the Philippines.

These are just some of the emerging key trends in the Philippine property sector now after the pandemic.

Other key trends, according to SKF are as follows:

Retail and tourism

From phones to malls, brick-and-mortar retail is back. More local and international brands are coming in as Metro Manila’s retail market returns.

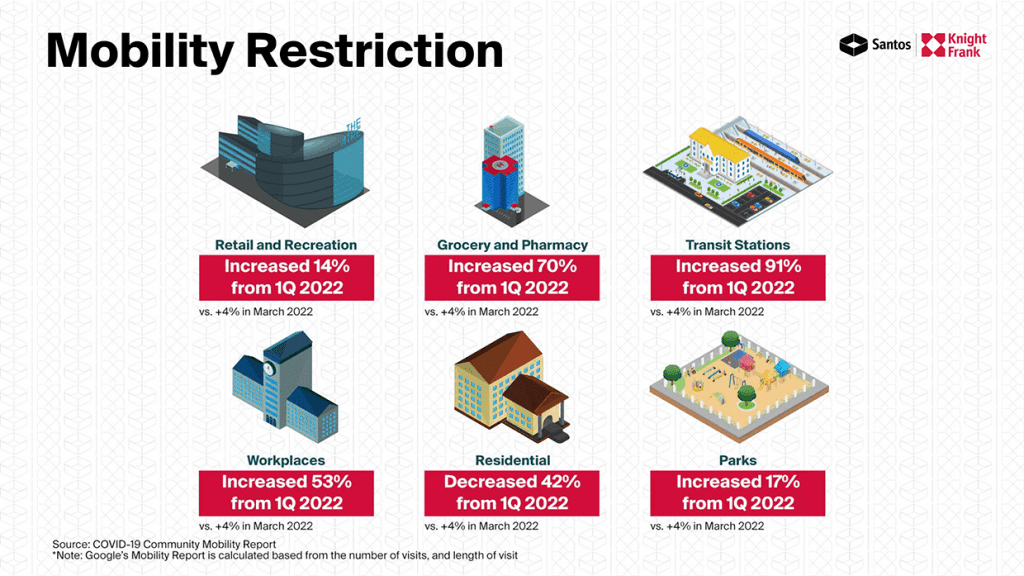

There will be more revenge recreation this year, propelling hospitality and tourism. Easing travel restrictions have resulted in increased travel mobility and leisure activities.

Office market

Inflationary pressures globally, cost-cutting measures, and tech layoff are driving the continuous growth of outsourcing and leasing activities in the Philippines and India.

US companies are confident with the Marcos administration. The Philippines is now much better positioned to attract investments from overseas.

Occupiers are looking more and more in secondary cities for their second and third office expansion.

Expect to see more property redevelopment to attract tenants.

Residential

Second homes will still be on the rise in emerging estate developments and destinations.

Industrial and data centers

The momentum for industrial continues. As markets recover from the pandemic, greater activities in construction, manufacturing and e-commerce will demand more storage.

The Philippines is poised to be the next data center hub in Southeast Asia.