The Philippine property market is rebounding and we can see this revival in the office segment.

Metro Manila office space transactions are improving and this optimism is spilling over to major cities and provinces outside the capital region as tenants, especially outsourcing companies, firm up their business continuity plans.

Companies are gradually returning to their respective offices, resulting in improving take-up of office spaces across the country.

Colliers Philippines believes that positive sentiment from the business sector is likely to translate to greater office space absorption over the next 12 months despite the implementation of hybrid work models.

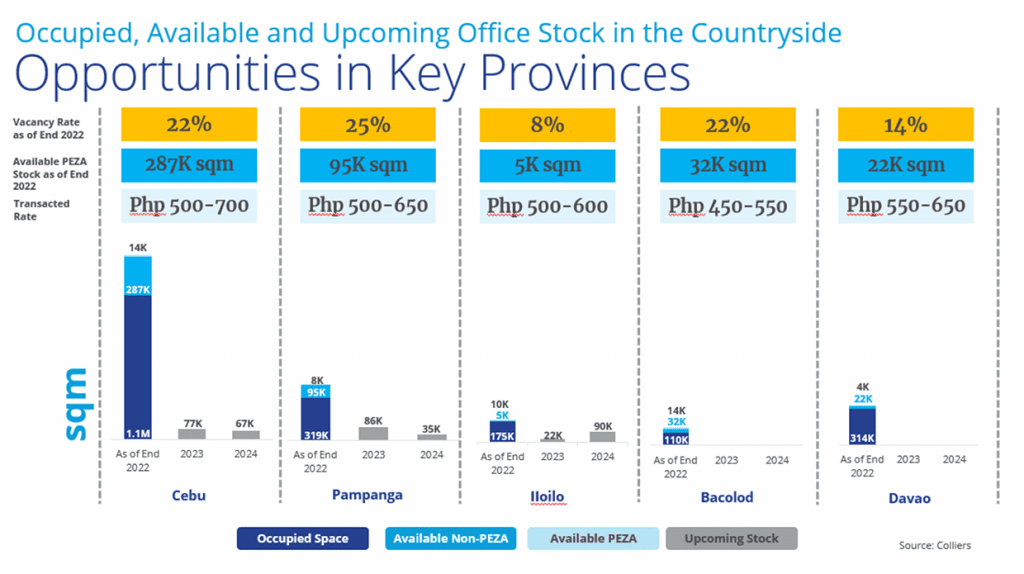

As companies continue to expand and lease more office space, Colliers Philippines believes that landlords should be mindful of their development pipelines and continue exploring opportunities in the countryside in anticipation of greater provincial demand from outsourcing and traditional occupants.

Firms should closely monitor supply gaps in areas with low vacancies. As tenants become more creative with their leasing strategies, Colliers believes that landlords should also consider partnering with flexible workspace operators.

Tenants, on the other hand, should consider executing flight-to-value strategies and occupying new and high-quality spaces being offered at discounted lease rates.

Given the newer and better normal, firms should also integrate flexible workspaces into their leasing strategies.

Philippine office transactions up

In 2022, office space deals within and outside Metro Manila reached 824,900 square meters, up 54 percent year-on-year. Outsourcing firms drove office demand in the country.

Outsourcing transactions in Metro

Manila and provincial locations reached 405,800 sqm last year, accounting for nearly 50 percent of total office space deals during the year. Meanwhile, take-up in the provinces from outsourcing companies reached 149,800 sqm or 37 percent of total outsourcing transactions in the country.

Among the provinces that cornered the majority of the transactions are Cebu, Davao, Pampanga and Laguna.

In our opinion, the implementation of the work-from-home (WFH) setup and the rising popularity of hybrid work models such as ‘work-from-anywhere’ and ‘hub-and-spoke’ are also changing the landscape of the outsourcing industry as many employees opt to stay in their provinces.

As of end-2022, the Information Technology and Business Process Association of the Philippines (IBPAP) reported that about 31 percent of the country’s IT-BPM (Information Technology and Business Process Management) headcount or 486,000 full-time employees (FTEs) were in the countryside.

Colliers believes that key areas including Bacolod, Cebu, Baguio, Davao, Iloilo, Pampanga, Cavite, and Laguna will likely remain as viable options for outsourcing firms planning to expand outside Metro Manila due to their competitiveness and skilled manpower.

Based on the results of Tholons Services Globalization Index in 2023, these areas were among the top 250 outsourcing sites in the world. Among Tholons’ criteria are talent, skill and quality, business catalyst, cost and infrastructure, and innovation and capital.

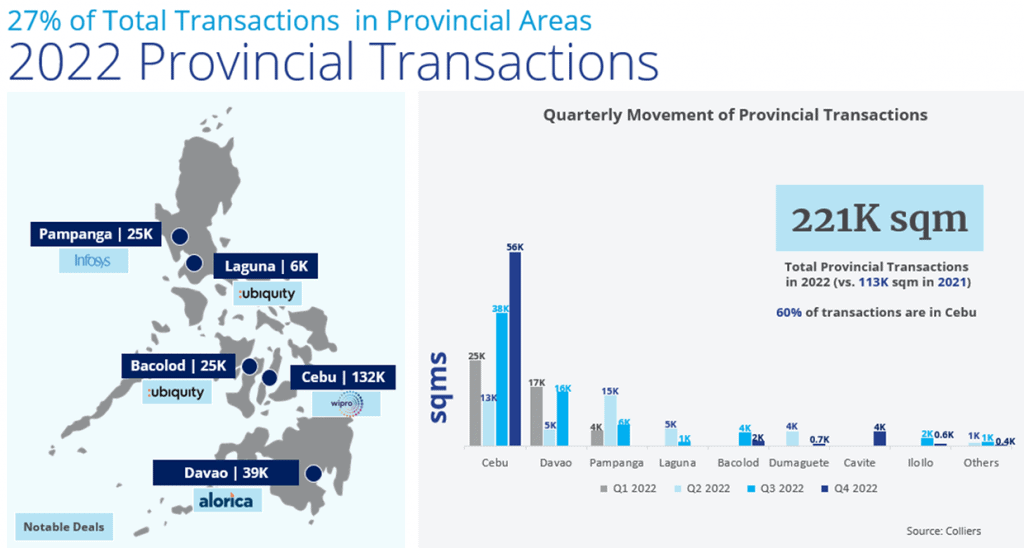

Growing deals outside Metro Manila

In 2022, office deals outside Metro Manila reached 221,100 sqm, nearly double the 113,100 sqm recorded a year ago. Cebu, Davao and Pampanga covered 89 percent of total provincial transactions.

Among the notable deals in 2022 are spaces taken up by Concentrix, Wipro and Avant Offices in Cebu, Alorica in Davao, and Infosys and Asurion in Pampanga.

Colliers believes that these firms have been expanding outside Metro Manila due to attractive rents as well as the availability of high-quality office spaces and skilled and well-educated manpower.

Tap opportunities outside Metro Manila

Colliers recommends that developers complete delivery of their projects as scheduled as we have observed increasing inquiries from outsourcing firms, especially in Iloilo, Bacolod, Bulacan and Laguna.

Colliers expects the completion of about 380,000 sqm of new office space in Cebu, Pampanga, and Iloilo from 2023 to 2024.

We also encourage developers to be on the lookout for potential demand in key cities such as Iligan, Dagupan, Urdaneta, Malolos, General Santos, Tarlac, Cabanatuan and Puerto Princesa as these locations are among those touted as high potential areas for “transformation into digital cities by 2025” according to the Information and Business Process Association of the Philippines (IBPAP).

Overall, Colliers Philippines believes that the office market is definitely on an upswing. Both tenants and landlords should not be left behind in reaping the constantly expanding and rebounding office market’s low-hanging fruits.

The enormous opportunities are up for the taking. – Martin Aguila and Brent Respicio