Philippine property recovery spills over into 2023

The Philippine property market is likely to finish the year strong on the back of improvement in office deals across the country; higher supply and demand in the Metro Manila pre-selling condominium market; a rebound in mall consumer traffic; and a rise in hotel occupancies and average daily rates (ADRs).

We see this optimism persisting through 2023 as recovery prospects are boosted by strong macroeconomic fundamentals.

Office developers should take advantage of a rebound in leasing within and outside Metro Manila by constructing new office towers and offering more flexible workspaces; residential developers should launch new projects integrating sustainable & green features, as the Metro Manila pre-selling condominium market recovers; while mall operators should brace for more foreign and local retailers as consumer confidence and foot traffic pick up.

Industrial locators, meanwhile, should look at available space and warehouses in northern and central Luzon, which are viable alternatives to industrial parks and facilities in southern Luzon.

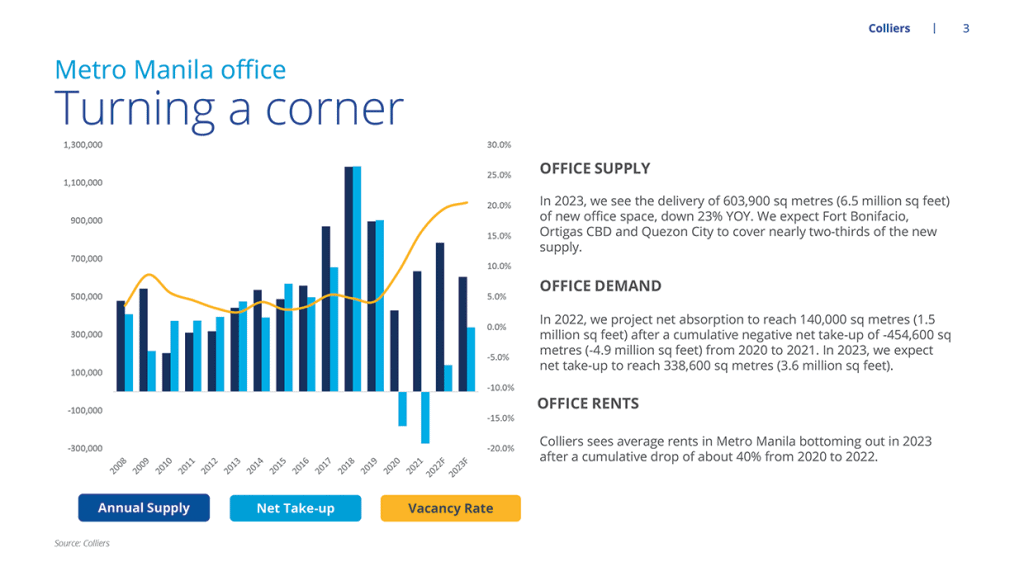

Office: Positive net take-up as transactions further rise

Colliers sees positive net take-up by the end of 2022. We forecast net absorption to reach 140,000 square meters, a turnaround after negative net absorption in 2020 and 2021. We adjusted our forecast to a 19.5 percent vacancy in 2022 from our initial estimate of 18.2 percent due to muted pre-leasing in upcoming buildings.

In 2023, we see net take-up improving to 338,600 sqm. However, we expect vacancy to rise to about 20.5 percent as we project the delivery of 603,900 sqm of new supply. Vacancy in Metro Manila will remain supply-driven.

Average office rental rates in Metro Manila have dropped by 35 percent since 2020. In our view, rental rates are likely to decline by another 10 percent in 2022 before bottoming out in 2023.

Colliers is starting to see rents stabilizing in submarkets with declining vacancies such as Fort Bonifacio and the Makati Central Business District (CBD). Meanwhile, submarkets with significant amounts of new supply and muted take-up are likely to see a further decline in rents in the next 12 months.

Colliers recommends that occupiers take advantage of the market conditions by implementing flight-to-quality measures as well as securing early renewals in business districts such as Ortigas CBD, Fort Bonifacio, and Bay Area where quality new supply is available.

From 2023 to 2026, we see the annual delivery of about 545,700 sqm of new office space. Landlords should continue providing concessions (e.g. delayed escalations, extended fit-out) to attract new occupants and retain existing ones amid the completion of more options in the market.

Colliers is optimistic about greater office space absorption in the provinces as occupiers revisit their business continuity plans (BCP) and expand operations by tapping provincial talent.

Developers are keen on capturing this demand outside the capital region by building more office towers. Key areas with substantial new supply up to 2024 include Cebu, Bacolod, Iloilo, and Davao.

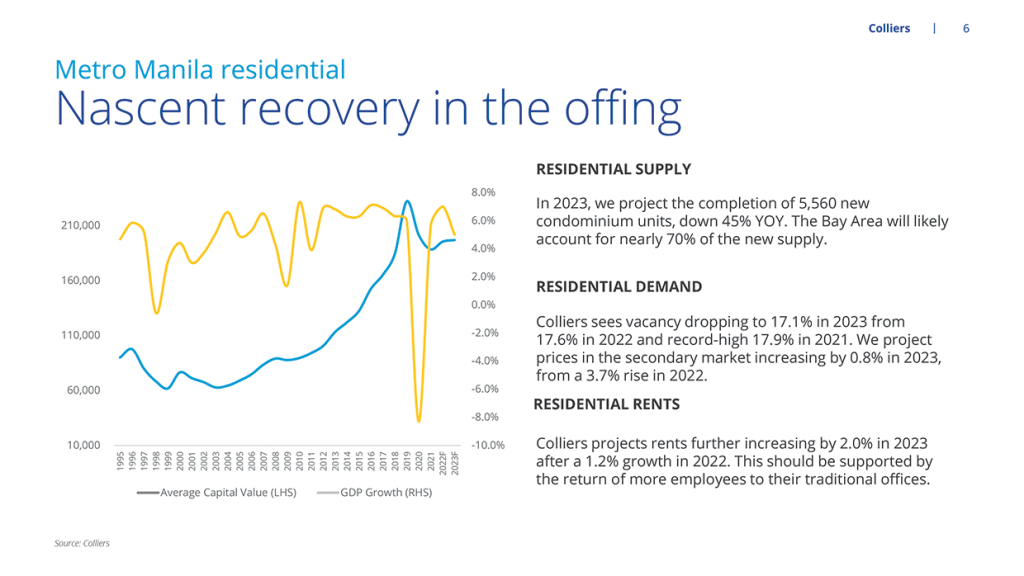

Residential: More integrated communities and sustainable features

Colliers sees an annual average completion of 8,100 units from 2022 to 2024, from the 7,800 units completed yearly from 2019 to 2021. By the end of 2024, we project condominium stock in major business districts in Metro Manila to reach 166,400 units, a 17 percent increase from 142,200 units in 2021.

The Bay Area will likely overtake Fort Bonifacio as the biggest condominium market in the capital region in 2024, with 44,100 units or 27 percent of Metro Manila stock during the period.

We expect vacancies in the secondary market to drop to 17.1 percent in 2023 from 17.6 percent in 2022. Residential leasing should be supported by demand from expatriates and local employees looking for condominium units near their workplaces.

Colliers, meanwhile, saw a pick-up in demand in the pre-selling condominium market in Metro Manila. As of 9M 2022, about 14,900 units were sold in the capital region, already outpacing full-year 2021 figures of 12,400 units.

While the mid-income market (PHP3.2 million to PHP6.0 million or USD54,200 to USD101,700) continued to dominate total take-up, we observed an increased demand for luxury projects (PHP8 million and above or USD135,600 and above).

The segment accounted for about 28 percent of total take-up in 9M 2022, up from −1.6 percent in 9M 2021, a negative share that reflects net back out. In our view, this market will remain resilient amid the rising interest and mortgage rates. Colliers believes that demand for luxury and ultra-luxury projects will likely be sustained as investors bank on these properties’ potential for capital appreciation.

We also recommend that developers highlight open spaces and green areas. Based on our Q3 2022 Residential Survey, about 90% of respondents believe that having green and sustainable features are important in purchasing a residential unit. Colliers sees more developers securing green building certifications for their residential towers.

We believe that this will play a crucial role in future-proofing residential projects.

Colliers also encourages developers to assess the viability of launching more master-planned communities to take advantage of the government’s infrastructure projects.

In the next 12 to 36 months, we see the completion of big-ticket projects including MRT-7, LRT-1 Cavite Extension, North-South Commuter Railway, and Cavite-Laguna Expressway (CALAX) raising the attractiveness of critical provinces in Central and Southern Luzon for more township developments.

(To be continued)