The Anti-Money Laundering Council (AMLC) is ramping up efforts to register more real estate brokers and developers as covered persons in the monitoring of dirty money transactions in the country.

Since the industry was included as persons or entities required to submit covered transaction reports (CTRs) and suspicious transaction reports (STRs) last January under Republic Act 11521 or amendments to RA 9160 or the Anti-Money Laundering Act (AMLA) of 2001, only about 11 percent of the 30,000 real estate brokers and developers licensed by the Professional Regulation Commission (PRC) has registered with the AMLC.

The country’s sole financial intelligence unit said only 3,300 real estate brokers and developers have been registered as of end May.

From only 50 registrations in February, the agency said a total of 1,526 real estate brokers and developers registered in March followed by a little over 1,100 in April, and 500 in May.

The AMLC added hundreds of applications from real estate brokers and developers are still pending and awaiting submission of relevant documents.

“The volume of registrations is also challenged by the limited manpower of the AMLC’s compliance and supervision group which handles registrations,” it said.

The group handles registrations of thousands of designated non-financial businesses and professions. Aside from real estate brokers and developers, lawyers, accountants, jewelry dealers and casinos are required to register with the AMLC.

Failure to register with the reporting system of the AMLC could result in penalties ranging from P10,000 to a maximum of P5 million, depending on asset size.

Under the revised AMLA, real estate brokers and developers are mandated to report single cash transactions worth P7.5 million and above to the AMLC.

This after Paris-based Financial Action Task Force (FATF) said dirty money proceeds are being funneled to the real estate into the real estate sector in several countries in Asia Pacific including the Philippines.

The AMLC said the country’s real estate sector has a medium high vulnerability to dirty money transactions due to limited anti-money laundering/combating the financing of terrorism (AML/CFT) regulation.

The agency received 142,562 covered transaction reports (CTRs) worth P684.4 billion as well as 5,416 suspicious transaction reports (STRs) worth P321.4 billion in 2019 and 2020.

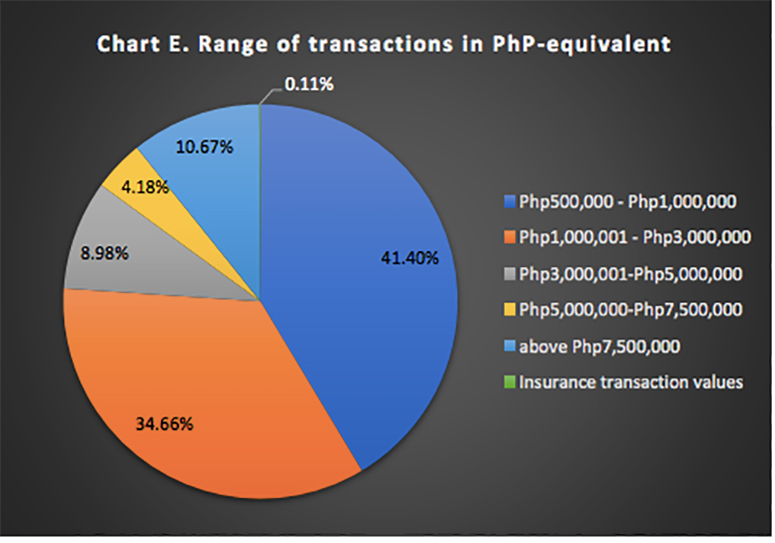

The AMLC noted most of the sample CTRs filed on accounts involving the real estate sector range betweenP500,000 and P3 million cornered 76.1 percent of the total, while transactions in excess of P7.5 million accounted for only 10.7 percent.

AMLC chairman and Bangko Sentral ng Pilipinas Governor Benjamin Diokno is confident that the Philippines would be stricken off the gray list on or before the January 2023 deadline set by FATF.