More than a year after the global pandemic and economic crisis, the Philippine residential real estate market experienced an upturn in the first quarter of 2021 as people were eager to invest after a decrease in the unemployment rate and a slightly improved consumer confidence in the previous quarter.

Although economic activity in the fourth quarter of 2020 was positive, research firm IHS Markit expects the surge in new COVID-19 cases in mid-March 2021 to curb the country’s economic recovery.

In a report, Lamudi looks into the performance of the residential real estate market in the first quarter of 2021 as consumers adopt new attitudes towards investments and purchases.

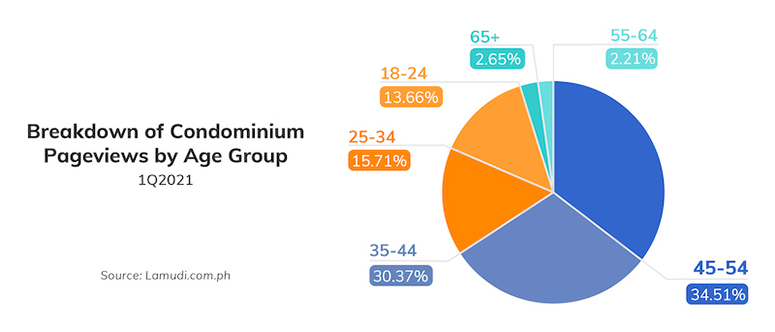

Gen X drives growth in condominium market

The first quarter of 2020 saw college students and fresh graduates leading in terms of page view growth for condominiums. However, consumer preferences in the first quarter of 2021 showed that seekers from the 45 to 54 age bracket commanded the highest year-on-year growth figures for page views for condominium listings at an impressive 106.80 percent. Seekers from the 35 to 44 age bracket also showed more interest in condominiums, exhibiting the highest quarter-on-quarter page view growth.

Lamudi’s previous trend report The Outlook on the Residential Market: Property Investment as a Safe Haven During a Crisis revealed a recovered demand for housing in central business districts in the first half of 2020. With flexible schedules and remote work continuing to be the norm, more C-suite executives within the age group may be looking at homes closer to their office.

Although lead growth from the 25 to 34 age bracket weakened this quarter, they still contributed the largest lead share for condominium units. Also, luxury condominium units priced above P20 million attracted the most page views, while listings priced from P1.5 million to P3 million contributed the most leads.

As more millennials look at real estate as a viable investment option, first-time buyers may be pursuing more immediately accessible price points albeit showing preference for aspirational residential options. Sellers may add value by retrofitting units with aspirational interior designs and lifestyle-centric amenities such as sleek modern furnishings, smart appliances, and large windows.

Apartments led the property search in terms of lead growth.

Leads for apartments increased by 16.11 percent in the first quarter of 2021 compared to the same period in 2020, driven by consumer desire for extra space without compromising affordability.

Seekers belonging to the 25 to 34 bracket led the demand for this property type. Its size is especially attractive to young professionals and couples planning to expand their family.

Out of the top five apartment location markets in the country, leads for apartments were most prevalent in Quezon City and Manila in the first quarter of this year, followed by Pasig, Makati, and Caloocan. Outside of Metro Manila, Cebu had the strongest apartment market. Meanwhile, Davao received the most pageviews for its apartments in the first quarter but Cagayan de Oro received the most leads.

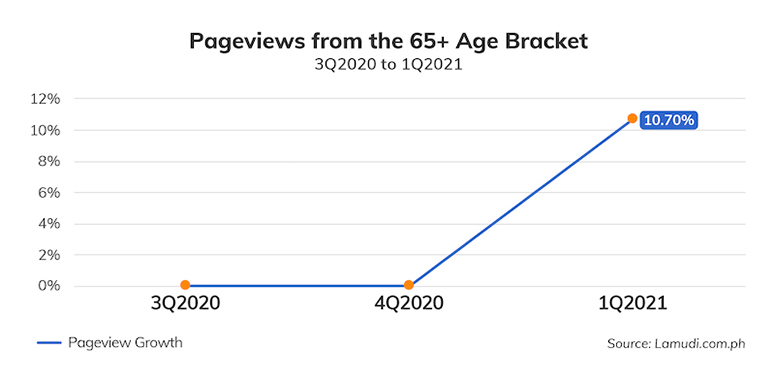

Residential market for retirees showed signs of recovery

Property seekers over the age of 65 showed the most optimistic growth figures in the first quarter of 2021. After a dip in annual page view growth in the first quarter of 2020, interest from the retiree market rebounded in the same period in 2021.

The positive trend is indicative of an older population adjusting to the internet and digital platforms. They also exhibited the highest year-on-year and quarter-on-quarter growth in page views for houses in the first quarter of this year, as well as the highest growth in annual page views for land listings as well.

The appeal of land as an appreciating asset makes it especially attractive given the increased aversion to risk following the global economic crisis.

Residential real estate supply in Q1 2021

In terms of supply, land and apartments experienced the largest growth in number of listings year-on-year in the first quarter of 2021. With the ongoing pandemic, some landowners may be seeking to liquidate their land assets. Given the increase in demand for warehousing and logistics spaces, others may be looking to create passive income streams by leasing out their assets for industrial or commercial use.

The recent crisis pushed consumers to consider their health and well-being in their purchases. More property seekers are expected to look at health-related amenities as a prime consideration in their purchasing decisions.

Fitness amenities such as swimming pools and gyms continue to be property seekers’ top desired property features alongside stable internet connection.

The future of residential real estate

The residential market has undoubtedly changed in the past quarter, with large shifts in preferences from different consumer segments. Lamudi has observed a more eager residential property seeker market because of a population that is becoming increasingly active in the online real estate space.

While the real estate market has shown optimistic signs in the first quarter of the year, the recent announcements of a stricter lockdown followed by an extension of that quarantine period is concerning. The improvement of our public health remains to be an essential driver of our economic recovery, and investment in any long-term asset will be more probable as both disposable income and consumer health improved. Should the vaccine rollouts be successful, both households and the economy should be making progress toward full recovery.