FY2020 HIGHLIGHTS:

· Bloomberry’s 2020 results were severely impacted by the COVID-19 outbreak which resulted in the temporary suspension of Solaire’s casino operations between March 16, 2020 to June 15, 2020. Since mid-June, Solaire has been operating at limited capacity across its gaming, hotel, F&B, and retail businesses and has only been catering to long-stay hotel guests and select invitees. Jeju Sun in South Korea has been closed since March 21, 2020

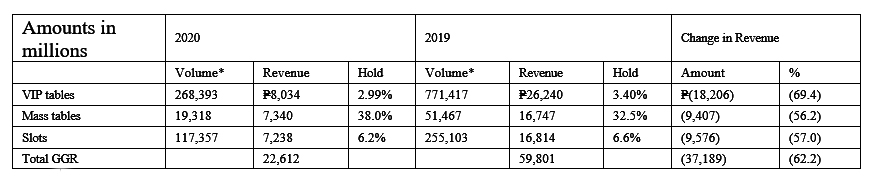

· Total Gross Gaming Revenue (GGR) at Solaire was P22.6 billion, 62% lower than the P59.8 billion recorded in 2019

· Solaire’s VIP, mass tables and electronic gaming machine (EGM) GGR were P8.0 billion, P7.3 billion and P7.2 billion, representing year-on-year declines of 69%, 56% and 57%, respectively

· Consolidated net revenue was P17.8 billion, representing a decline of 62% from P46.6 billion in 2019

· Consolidated EBITDA reached P1.4 billion, representing a decrease of 93% from P19.8 billion in the previous year

· Consolidated net loss was P8.3 billion, compared to net profit of P9.9 billion in 2019

· Consolidated cash and cash equivalents balance as of December 31, 2020 was P23.4 billion

· Capital expenditures made related to health, safety, and sanitation totaled over P400 million

· Bloomberry and ICTSI are assisting the Philippine Government in procuring Oxford-AstraZeneca and Moderna vaccines. Outside of vaccines, the Bloomberry Cultural Foundation, Inc. (BCFI) has donated over P850 million to various institutions in the form of medical supplies, personal protective equipment, funding for quarantine and treatment facilities, and relief goods

4Q2020 HIGHLIGHTS:

· Total GGR at Solaire was P5.3 billion, representing a decline of 63% from P14.5 billion in the fourth quarter of 2019 and a 22% improvement from the previous quarter. Combined mass tables and EGM GGR recorded a sequential improvement of 75%

· Consolidated net revenue was P4.2 billion, representing a decrease of 61% year-on-year

· Consolidated EBITDA was P129.3 million, a return to positive territory from LBITDA of P203.7 million in the previous quarter

· Consolidated net loss was P2.5 billion, compared to net profit of P1.4 billion in the same quarter of the previous year

Bloomberry Resorts Corporation (“Bloomberry”, “the Company”), whose subsidiaries own and operate Solaire Resort & Casino (Solaire) and Jeju Sun Hotel & Casino (Jeju Sun), reported audited consolidated financial results for the year ended December 31, 2020.

Enrique K. Razon Jr., Bloomberry Chairman and CEO, says, “I am encouraged by our performance in the final quarter of 2020, particularly as we saw domestic mass gaming revenues increase by 75% compared to the previous quarter and EBITDA hitting positive territory. Our recovery is well underway. We look forward to a more meaningful improvement in 2021 should we see further easing of domestic quarantine restrictions and the eventual resumption of travel and tourism across our key markets.”

“Our pre-eminent priority as our recovery progresses remains to be the wellbeing of our guests and team members. This concern has manifested in the form of sanitation and safety investments at Solaire valued at over P400 million for the year, ensuring our position as the leader in excellence, safety and health security among our peers in the Philippines and the region.”

“We stay true to our intrinsic obligation to help our countrymen as we assist the Philippine Government in procuring Oxford-AstraZeneca and Moderna COVID-19 vaccines. Outside of vaccines, the Bloomberry Cultural Foundation, Inc., has donated over P850 million worth of medical supplies, relief goods, and health infrastructure funding. We are eager to see a healthy post-pandemic world emerge through our continuing CSR efforts.”

Gaming Performance

Solaire’s casino has been operating at a capacity consistent with a limited dry-run since June 15, 2020, as allowed by PAGCOR; recall that PAGCOR suspended all gaming operations under its purview from March 16, 2020 to align with the government’s community quarantine initiative. Such dry run operations, which involve only long-stay and select invited guests, are a means for the industry to fine-tune its services in accordance with new normal protocols. Solaire is currently not open to the public and maintains an invite-only policy.

In 2020, total GGR at Solaire was P22.6 billion, representing a decrease of 62% from P59.8 billion in 2019. Solaire’s VIP, mass table, and EGM GGR in 2020 were P8.0 billion, P7.3 billion, and P7.2 billion, representing year-over-year declines of 69%, 56%, and 57%, respectively.

In the fourth quarter, total GGR at Solaire was P5.3 billion, representing a decrease of 63% from P14.5 billion in the same quarter of the prior year. However, GGR recorded a 22% improvement from P4.4 billion in the third quarter as domestic patron confidence improved and quarantine restrictions were mildly eased in October.

Mass table drop and EGM coin-in in the fourth quarter recorded sequential growth of 70% and 96%, respectively.

VIP GGR for the quarter was P1.2 billion, representing a sequential and year-over-year decline of 41% and 78%, respectively, due to international travel restrictions enforced throughout the period. Fourth quarter mass table and EGM GGR were P2.0 billion and P2.2 billion, representing sequential improvements of 78% and 73%, respectively. Mass table and EGM GGR, respectively, recorded year-over-year declines of 55% and 52%.

Jeju Sun reported gaming revenue of P93.1 million in the first 81 days of 2020, representing a decrease of 84% from P573.1 million in 2019.

Consolidated contra revenue accounts for 2020 decreased by 61% to P6.8 billion. This represents 30% of consolidated GGR compared to 29% in 2019. Consolidated contra revenue accounts in the fourth quarter of 2020 was P1.5 billion, representing 28% of consolidated GGR compared to 32% in the same quarter of 2019.

Consolidated net gaming revenue for the year reached P14.1 billion, representing a decline of 63% from P38.5 billion in 2019. In the fourth quarter, consolidated net gaming revenue was P3.4 billion, lower by 61% compared to the same period in the previous year.

Non-gaming Revenues

For roughly nine and a half months of 2020, the company operated limited areas of the hotel, F&B, and retail businesses at Solaire to cater to select invitees and remaining long-stay hotel guests who were stranded due to strict quarantine and travel restrictions.

The Company reported consolidated non-gaming revenues of P3.7 billion for 2020, representing a decline of 55% from the P8.2 billion generated in the previous year. In the fourth quarter, consolidated non-gaming revenue was P761.3 million, lower by 65% compared with the same quarter in 2019.

At Solaire, non-gaming revenue for the year was P3.7 billion, representing a decrease of 54% from 2019. Hotel occupancy in 2020 was 30.2%, compared to 90.5% in 2019.

At Jeju Sun, non-gaming revenue in 2020 declined by 80% year-over-year to P25.9 million.

Net Revenues

Bloomberry’s consolidated net revenue in 2020 was P17.8 billion, representing a decline of 62% from P46.6 billion in 2019. Consolidated net revenue in the fourth quarter was P4.2 billion, representing a decrease of 61% from the comparable period in 2019.

Expenses

Consolidated cash operating expenses reached P15.6 billion in 2020, lower by 41% compared to P26.5 billion in 2019. The decrease in cash operating expense is consistent with the reduced scope of operations at Solaire and Jeju Sun for most of the year. Consolidated cash operating expenses in the fourth quarter were P3.9 billion, lower by 42% compared with the same quarter in the previous year.

EBITDA, Net Profit and Earnings Per Share

The Company’s 2020 consolidated EBITDA was P1.4 billion, representing a decrease of 93% from P19.8 billion in 2019. Solaire contributed P1.8 billion to consolidated EBITDA, which was off-set by the P394.9 million LBITDA recorded at Jeju Sun. Consolidated EBITDA in the fourth quarter was P129.3 million, lower by 97% year-over-year, but a reversal from consolidated LBITDA of P203.7 million in the previous quarter.

On a hold-normalized basis, Bloomberry’s consolidated EBITDA for 2020 was P1.2 billion, P187.8 million lower than the reported consolidated EBITDA of P1.4 billion. Hold-normalized EBITDA in 2020 would have decreased by 93% year-on-year. Hold-normalized EBITDA in the fourth quarter would have been P347.2 million, representing a 92% decrease from hold-normalized EBITDA for the comparable period in 2019.

The Company reported consolidated net loss of P8.3 billion for 2020 compared to net profit of P9.9 billion in 2019. Net loss in the fourth quarter was P2.5 billion, compared to net profit of P1.4 billion in the same quarter of the previous year.

Bloomberry reported Basic Earnings per Share (EPS) loss of P0.758, compared to EPS gain of P0.903 in 2019.

Balance Sheet and Other Items

As of December 31, 2020, Bloomberry had a consolidated cash and cash equivalents balance of P23.4 billion. Total long-term debt was P68.6 billion, which represents the balance of the current and non-current portions of the amended P73.5 billion and P40.0 billion Syndicated Loan Facilities. Total equity attributable to equity holders of the parent company was P32.9 billion.

On December 21, 2020, Bloomberry’s lenders agreed to amend the P73.5 billion Syndicated Loan Facility to extend an Additional Facility in the principal amount of P20.0 billion which will be available for drawdown for two years from the date of signing. Any amount borrowed will be payable within five years from the date of the first drawdown and will be used to supplement Solaire’s capital expenditure and working capital requirements and other general corporate purposes. The Company’s lenders also granted the deferment of covenant testing for both the amended P73.5 and P40.0 billion Syndicated Loan Facilities until June 30, 2023.

As of December 31, 2020, the Company has not drawn on the P20 billion Additional Facility, while it has drawn P1.9 billion from the P40.0 billion Syndicated Loan Facility that was set up to fund the construction of Solaire North.

As of December 31, 2020, Bloomberry had P1.7 billion in net receivables, 43% lower than at the beginning of the year due to significantly reduced credit issuances. The Company made P149.9 million of additional provisions for bad debt in the fourth quarter, representing 5.4% of gross receivables.

Regarding Corporate Social Responsibility efforts, the Bloomberry Cultural Foundation, Inc. (BCFI) has donated over P850 million to various institutions in the form of medical supplies, personal protective equipment, funding for quarantine and treatment facilities, and relief goods.

Further, Bloomberry and its sister company International Container Terminal Services, Inc. (ICTSI) have become key players in the Philippine Government’s battle against COVID-19. Both Bloomberry and ICTSI have participated in two of the most advanced private sector-assisted vaccination procurement programs to date, particularly for bringing in three million doses of the Oxford-AstraZeneca vaccine and an estimated 20 million doses of the Moderna COVID-19 vaccine. The group has committed 50% of its 300,000 purchased Oxford-AstraZeneca doses to the Philippine Government, while negotiations for the procurement of Moderna vaccines are in the advanced stages. We hope to secure these vaccines at the best possible price in the shortest amount of time for the sake of our countrymen.

About Bloomberry Resorts Corporation

Bloomberry Resorts Corporation (PSE: BLOOM) is a public company listed on the Philippine Stock Exchange that develops destination resorts featuring premium accommodations, gaming and entertainment, and world-class restaurants and other amenities. Bloomberry Resorts Corporation’s subsidiaries own and operate the Solaire Resort & Casino (Solaire) in the Philippines and Jeju Sun Hotel & Casino (Jeju Sun) in Korea.

The company’s flagship property, Solaire Resort & Casino, is a USD $1.2 Billion integrated destination resort on an 8.3-hectare site in Manila, Philippines and the first to open in the PAGCOR-sponsored economic development zone known as Entertainment City.

For more information, please visit http://www.bloomberry.ph and https://www.solaireresort.com

Released