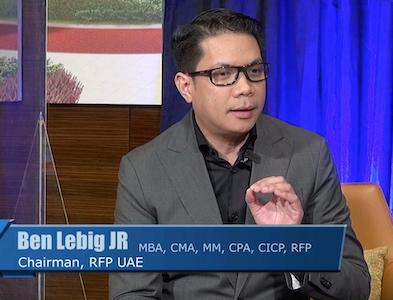

Overseas Filipino, expatriate, overseas community leader. There are many things you may call Ben Lebig, Jr. Yet when you meet him, albeit virtually, his humility and spirit will immediately win your respect. Ben is a family man, an executive at oil giant Chevron, entrepreneur, advocate, and happy SM Development Corporation (SMDC) investor and homeowner.

“The pandemic is not like anything we’ve experienced in our lifetime,” Ben begins. “For us here, especially for myself, it’s a double-edged sword because I’m not only responsible for my family and myself. I’m also a community leader here in the UAE.”

The Filipinos in UAE are 800,000-strong. A large number of them are in Dubai. Ben, who had always worked closely with the Philippine Consulate and other community leaders in Dubai, saw firsthand the pandemic’s effect on Filipinos there.

“With job cuts, pay cuts, redundancies, and all of that, it’s been our responsibility, as leaders, to help as much as we can,” he shares.

A role model

Ben currently works as a finance and decision support analyst for Chevron, covering Europe, Middle East, and Africa. He is the focal point of the development of the oil company’s business plan for the said regions. Budget, business plans, strategy, name it — this Filipino is at the center. He has the business plan for the regions factored into the US mother company’s business plan.

It is also right to say that when it comes to finance, Ben has the aptitude. So much so, he also serves as the chairman of Registered Financial Planners Association of the Philippines – UAE chapter. This is where Ben’s advocacy of financial literacy comes into play. He helps fellow Filipinos in the UAE with their financial decisions and investment goals.

Ben understands the weight of what he says to the other OFWs in the UAE. He is quick to give guidance to Filipinos from all walks of life.

Time to diversify

The acquisition of SMDC properties in the Philippines was not a decision that Ben and his wife made lightly, especially since they decided to go for it in the middle of a pandemic.

“It took months of preparation and months of research. As a finance person myself, the financial aspect is a big component of our decision-making,” says Ben.

Ben has other investments: paper assets, mutual funds, variable universal life insurance, stock market, and a business.

“I am a co-owner of a company in the Philippines that produces dragon fruit. We have five farms right now, in Ilocos, Arayat and Batangas. The long-term plan is to export,” he shares.

He knew it was time to diversify his investment portfolio. The most logical next investment was real estate. “Real estate is a hard asset. Other investments might become unstable, but not real estate,” he says thoughtfully. “It’s always a comforting thought that real estate will always be there. That’s why we came into this gradual trajectory for our diversification.”

SMDC as the best choice

After three months of due diligence, researching real estate companies in the Philippines, Ben and his wife decided to go for SMDC. They knew it was the right decision.

“Believe it or not, the pandemic was also a good push for us. Because of the pandemic, we realized that real estate is one of those defensive investments that we should have. Real estate is resilient,” says Ben.

Everything in one place

He believes his investment choices are strategic and have sound financial value. Earlier this year, he was in Manila for a business trip. He stayed with a friend who was a resident of Light Residences. He fell in love with the place.

“I loved the place, its amenities, and the idea of having a mall within the development because of the convenience it provides. The strategic location is fantastic,” Ben says.

He decided to also invest in Sail Residences because of his vision of what the area will eventually become. He says that one should always see beyond what is in front of him. “Mall of Asia (MOA) is the center,” he says.

MOA’s location makes traveling to the rest of Metro Manila, Cavite, Laguna, and Batangas a breeze.

A bright future with SMDC

Ben can clearly visualize the developments in MOA in the coming years: “We’re very excited about Sail Residences because of what it can offer to us at the turnover time. What the MOA area will look like and its potential brings value to investors who own property on that side of Manila.”

Those two things were the driving forces that helped him decide to invest in an SMDC property without hesitation: “The main factor for investing in real estate with SMDC is the investment value. You see the potential of the place, the potential of a property on that side of town. Whether we choose to retire in the Philippines or not, it doesn’t matter. At this point, we look at these properties as investment portfolio items.”

SMDC and the OFWs’ hard-earned money

It was a question that begged to be asked: “What makes SMDC worth your hard-earned money?”

“SMDC has always been known to provide not only high-quality projects but also projects that are very strategic, very viable. It has already perfected this integration of urban living with a mall and with world-class amenities you can enjoy. Whether it’s five or 15 years down the line, they’ll be our partners because they built our properties,” he says.

“In the middle of a pandemic, we decided to invest with SMDC because we have seen what they can do. We see how they delivered their previous projects and the quality of their projects. SMDC will protect the SM brand, so they will do everything in their power to make sure they deliver above the expectations of their clients,” he caps.

Ben knows without a doubt that he did the right thing when he invested in SMDC.

For more information on SMDC, please visit www.smdc.com.