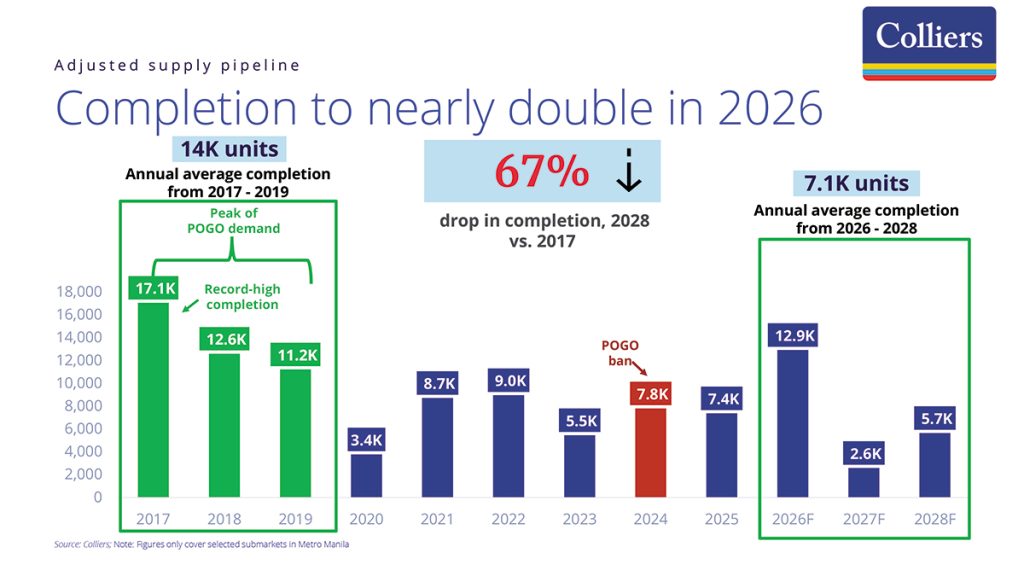

Colliers Philippines is forecasting limited turnover of new condominium units in Metro Manila from 2026 to 2029. It appears that developers are now tweaking their strategies and are limiting their launches following challenges in the pre-selling sector that we saw in 2020 and 2021.

Complementing the limited launches in Metro Manila, several developers are starting to look at fringe locations. Within the capital region, some firms are exploring the attractiveness of lot-only developments. Outside of the capital region, horizontal projects remain attractive, and we expect these developments to remain popular as they cater to Filipino end-users.

Strategic expansions in Metro Manila and beyond

As the Metro Manila condominium market continues to face challenges, several developers are aggressively implementing their geographic diversification. Colliers recommends that property firms carefully assess the attractive product types and price points in the locations where they are planning to expand.

A number of property firms have announced the expansion of their residential footprint across the country. Cebu Landmasters Inc. (CLI) is planning to spend PHP12 billion (USD203 million) on its initial projects that include a horizontal development in Batangas or Cavite, as well as a vertical project in Metro Manila. In October 2025, CLI broke ground on The Wave Towers in Cebu, a joint venture luxury condominium project with NTT UD Asia.

Meanwhile, DMCI is set to launch One South Drive, a luxury condominium project in Baguio City, and Moriyama Nature Park, a leisure-oriented development in Laguna that will feature a condotel.

In our view, the demand for horizontal projects should partly be driven by remittance-receiving households and end-users planning to locate in less dense communities outside Metro Manila. Luxury and leisure-themed developments, meanwhile, will likely remain attractive investment options, especially among discerning and affluent buyers banking on properties’ price appreciation.

Assess market viability for lot-only

Colliers recommends that developers assess the viability of launching more lot-only projects. In our view, lot-only projects are attractive given their large cuts, greener and more open spaces, and potential for price appreciation. Colliers data showed that lot-only developments in key regions such as Southern and Central Luzon, Central Visayas, Western Visayas, and Davao regions recorded formidable price appreciation of between 8% and 18% annually from 2016 to 2024.

The strong preference for lot-only projects is starting to gain traction within Metro Manila. Given the limited supply and rising demand, we expect the prices of these lot-only units in the metro to increase in the years to come. Interestingly, developers primarily focused on mid-income projects are now targeting the higher-priced residential segment with an emphasis on expansive horizontal communities.

For instance, SM Prime launched its Signature series, which will offer premium residential lots and will be located across several provinces and Metro Manila cities such as Muntinlupa, Makati, Pasay, Paranaque, Taguig, Pasig, Cavite, Batangas, Palawan, and Cebu. The first project will be located in Susana Heights, Muntinlupa.

Explore niche markets across peripheries

The lack of developable land and soaring prices in central business districts (CBDs) are driving more developers and investors to consider condominium projects in Metro Manila fringe areas. The results from our Residential Survey showed that our respondents are considering buying condominium units in peripheral areas such as Makati Fringe, as well as parts of Quezon City and Pasig City.

In our opinion, property firms should further assess the feasibility of student-centric condominiums. We encourage developers to continue exploring this market and further look at developable areas near universities in Quezon City, Manila, and Pasay. For instance, Colliers’ data showed that condominium projects along Katipunan, Quezon City area are doing well, with projects priced from PHP 2 million to PHP 11 million (USD 35,000 to USD 190,000), enjoying an average take-up of nearly 60% as of Q4 2025. Among the recently-launched projects within the area include Arthaland’s Liv North and Avida Land’s The Heights Katipunan.

#PropertyReportFeature

#FeaturedStory