Many start-ups forget that sales are not the same as income, and that you need to manage your capital before spending.

Growing up, my parents used to say, “Money does not grow on trees. You must learn the value of hard work.” So I only got new shoes when the soles had worn out or a new uniform when the color had faded. My kids would remind me that I have told them these stories many times over.

During this pandemic, I found a new way to relay the same message to my 18-year-old son. Since people under 21 are forced to stay home, my son has thankfully taken up a new skill to occupy his time — baking cookies. Surprisingly, the cookies were delicious. They were simultaneously chunky and chewy, passing the discerning tastes of the entire household.

He then entertained the idea of selling them to our neighbors since many have been selling stuff and food specialties since the lockdown. My husband and I encouraged and guided him all the way, knowing that this opportunity to teach the elements of entrepreneurship and financial management firsthand may never present itself again. After all, another lesson among the many my parents taught me is that “experience is the best teacher.”

1. Differentiate. There are many cookie sellers. What makes your cookies different? He said that his cookies are chunky, chewy and fresh off the oven.

2. Brand. There are many food sellers and they just announce products for sale. How will you be distinctly remembered? So, the brand CHOO was born for chunky, chewy Cookies Hot Off the Oven. You need a name that can be easily recalled and stands for your distinct offering.

3. Product quality. This should not be compromised. He had to deliver on his promise of chunky, chewy and fresh off the oven. He had to ensure the taste is consistent, thus the ingredients should be high quality and strictly measured. He realized that many of his customers have become repeat customers.

4. Income, costing and pricing. His business management and math classes came in handy and so did MS Excel. Many start-ups forget that sales are not the same as income. He had to know and manage his costs well. It was important to measure his ingredients and canvass for the best price. He also had to price competitively, reflective of the quality of his product vis-a-vis substitutes. He knew there were lower priced alternatives but, to deliver on his brand promise, he couldn’t compromise on the quality and portions of ingredients.

5. Target market. His captured market was our neighbors, and their market profile had to be considered in his product development, branding and pricing.

6. Marketing, selling and production. “A picture is worth a thousand words.” He developed e-posters showcasing his three base cookie variants and three premium products that are sumptuously depicted with melt-in-your-mouth description. The village Viber groups were the most effective channel during the ECQ and do not cost anything. To manage supply and demand, he set baking schedules on Wednesday and Saturday, announced on Monday and Thursday, and obtained pre-orders on Tuesday and Friday. He also came up with special offers for Mother’s Day and Father’s Day, creating multi-variant ensembles so families can enjoy and sample all his different cookies in one order.

7. Product innovation and development. Using the same principle as limited edition or flavor of the month offers, he sustained interest and demand by introducing a new cookie every month. In June, he introduced the Chocolate Raisin Oatmeal Cookie or CROC. This July, he launched his new line made out of coco sugar, positioning it as the healthier alternative to white and brown sugar.

8. Managing capital. He wanted to purchase a mixer which, while useful, was quite expensive. This would entail dipping into his capital and if this was only a short-term venture over the quarantine period, he might regret making this capital expenditure. So we advised him against it and told him, hold off on this investment until the business reaches a certain scale. In the meantime, he has begun to think about how to make his improving capital position work harder.

So, he has begun to think about putting extra funds, in excess of his working capital, in time deposit to earn a higher interest rate. He even thought that perhaps he should exchange pesos to dollars. To round up his options, I introduced him to investment funds that are low-risk such as money market fund and short-term funds. I showed and explained to him the features of these products that can all be found in BPI Online.

In the midst of this pandemic, we hear more bad news than good news. I write this with the hope it provides inspiration to parents as they shepherd their kids in this new normal.

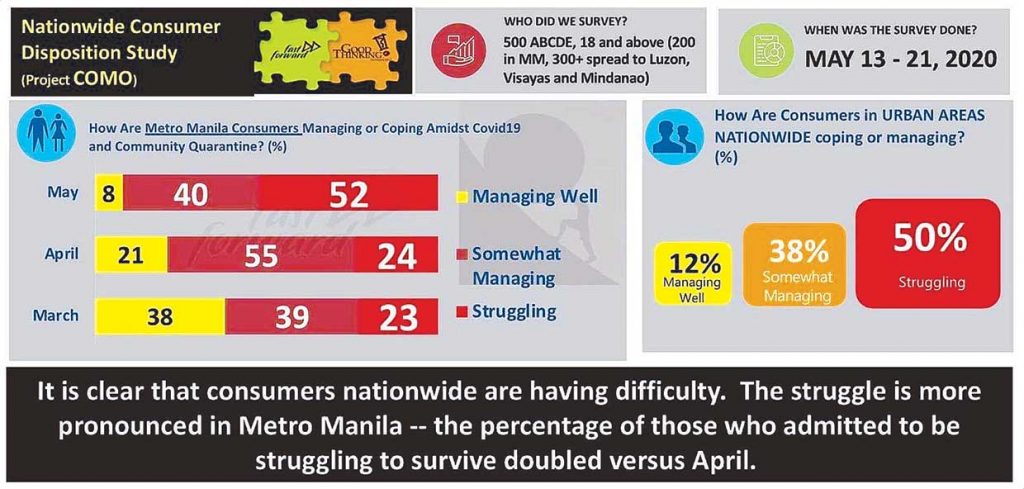

In a study by FastForward Market Research among Metro Manila consumers, those who said that they are managing well in this environment have drastically declined from 38 percent in March down to only 8 percent in May.

This pessimism is shared even by those in the C-suites (CEO, COO, CMO). In the same research, three out of four business leaders surveyed expect that this pandemic makes it nearly impossible to attain their business goals and that one out of three believes the impacts will be felt beyond 2020.

I have yet to see whether my son’s interest in this maiden venture will be sustained after the quarantine and when classes resume. He is actually already planning for Christmas orders, expecting that people will remain hesitant to go out and shop. We introduced him to the importance of seasonal packaging if his business will participate in the Christmas sales.

During one of the discussions my husband and I had with him, he told us, “Thank you Dad, thank you Mom, I’m glad you’re guiding me, and I am learning more with you now than when I was in school. I hope I can be as successful in the future as you both are.” As parents, we are our children’s first teachers and all we could hope for is that we taught them well in preparation for a brighter future, and give the resilience to withstand difficult situations. For now, I feel like my prayers have been answered.