The rise of more global capability centers (GCCs) is creating demand in the country’s office market as more foreign firms see the Philippines as a viable option for their offshore centers, according to a property consultancy firm.

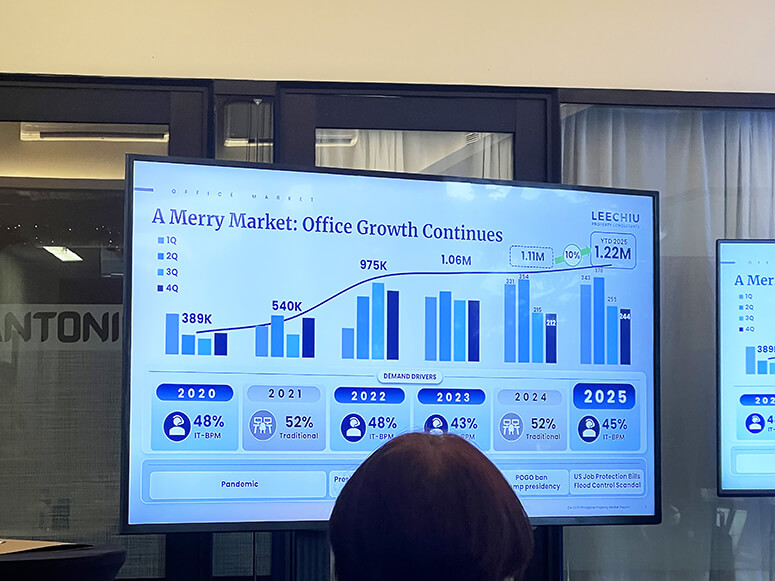

In a media briefing on December 10, Leechiu Property Consultants (LPC) director for commercial leasing Mikko Barranda shared that the country’s office market posted a 10 percent year-to-date growth in terms of demand to 1.22 million square meters (sqm) from 1.11 million last year.

Barranda said the office sector has been heavily anchored on the information technology-business process management (IT-BPM) industry in the past six years.

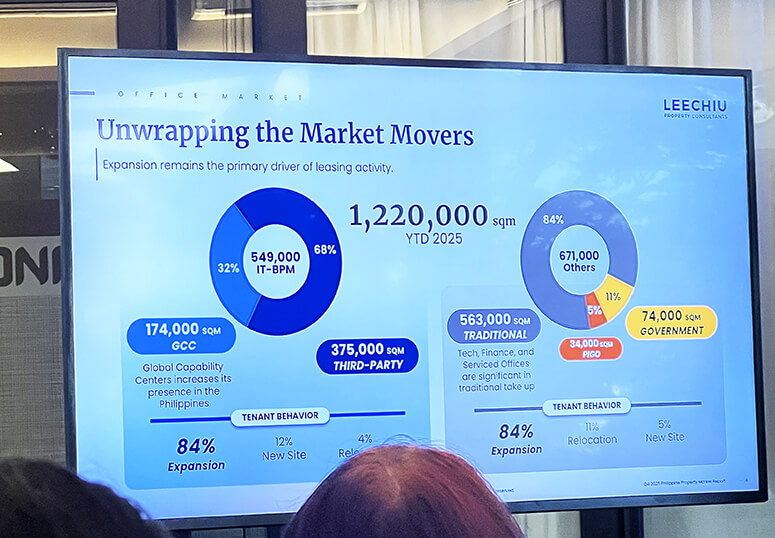

Data from LPC showed that year-to-date office space demand from the IT-BPM sector reached 549,000 sqm this year. Of the total demand from the IT-BPM sector, 174,000 sqm were from GCCs, while 375,000 sqm were from third-party service providers.

“The story here is what you see this year, which is a rise of what we call the global capability centers or GCCs, or formerly known as captive tenants. So basically, these are companies or BPOs that set up shop here and service their own. You’ve seen quite a few of these big multinationals like JPMorgan, Wells Fargo, etc. We’re also seeing new players primarily represented in the healthcare industry, finance, etc,” Barranda said.

“The existing ones have been expanding, but more importantly, there are new enterprises. So new names, new brands that are mostly Fortune 500 companies that are setting up here. Basically, they’re still seeing the Philippines as a viable option for offshore centers. We have 25 years, 20 years of track record in terms of supporting that particular industry,” Barranda said.

The LPC official emphasized that while there’s still a lot of opportunity for the industry to continue to attract these kinds of tenants, the country also needs to be able to produce the right talent to support these companies when they do end up setting up operations.

“We’re quite excited to see the growth in GCCs, global capability centers. We do need to deliver the talent necessary to be able to supply the talent to these companies,” Barranda said.

Aside from the IT-BPM sector, other drivers of office space demand were traditional firms with a total of 563,000 sqm. This is composed mostly of tech, finance, and serviced offices. Government offices also registered a total of 74,000 sqm in demand.

In terms of location, LPC data showed that 78 percent of the demand, or 948,000 sqm, was for offices in Metro Manila, while the remaining 22 percent, or 272,000 sqm, is located in provincial areas.

Bonifacio Global City was the top location of office space demand in Metro Manila at 218,000 sqm, a 73 percent increase from a year ago. This was followed by Quezon City with 169,000 sqm and Ortigas and Mandaluyong with a total of 155,000 sqm.

For the provincial areas, Cebu led as the top location, accounting for 55 percent of the demand at 150,000 sqm. This was followed by Clark with 26,000 sqm and Iloilo with 25,000 sqm.

Meanwhile, LPC reported that the volume of vacated spaces dropped 59 percent quarter-on-quarter to 85,000 sqm from 205,000 sqm in the third quarter. Year-to-date vacated spaces totaled 744,000 sqm.

It added that net take-up registered at 476,000 sqm, a 13 percent rise from the 422,000 sqm in the previous year.

The property consultancy said Metro Manila office vacancy currently stands at 18 percent with a total of 2.7 million sqm of available space.

Makati registered the highest vacancy volume among districts with a total of 591,000 sqm or a vacancy rate of 15 percent. LPC noted that 328,000 sqm of these are buildings that are older than 20 years.

This is followed by the Bay Area with 548,000 sqm and Ortigas and Mandaluyong with 542,000 sqm.

#PropertyReportFeature

#FeaturedStory