For the conclusion of Colliers Philippines’ property outlook, it is important that we put the spot on the industrial sector.

This segment has shown resilience even at the height of the pandemic. But somehow the segment is now at the crossroads as developers face the potential challenge of sizable new industrial supply likely putting a downward pressure on lean leasehold and modern warehouse lease rates. Developers need to be more strategic with their new launches moving forward.

From 2026 to 2028, Colliers sees the delivery of 870 hectares of new industrial supply in Central Luzon, more than quadruple compared to the 200 hectares of expected new supply in Southern Luzon during the same period.

With an improving business environment and bullish prospects for the region, we see more high-value manufacturers locating in Central Luzon, especially in Pampanga, Tarlac, Bulacan, and Bataan.

Industrial park and modern warehouse developers in Central Luzon should be mindful of the requirements of new and expanding locators in the region. We also encourage industrial developers to build more PEZA-accredited warehouses in Central Luzon, especially in Clark in Pampanga and Capas in Tarlac, due to their strategic locations and proximity to the Clark International Airport.

Higher-value locators to drive industrial space absorption

Colliers expects a downward pressure on pricing (land leasehold and warehouse rates) in South Luzon due to rising vacancy as a result of sizable new supply, as well as a slowdown in demand for big-box warehouses. The rise in vacancy should be partly tamed by previous investment commitments likely to materialize over the next 12 months.

We see manufacturers of semiconductors, consumer goods, cosmetics, renewable energy components, and automotive firms, including electric vehicles (EVs), driving industrial demand over the next 12 months.

Land lease extension a boon to industrial sector

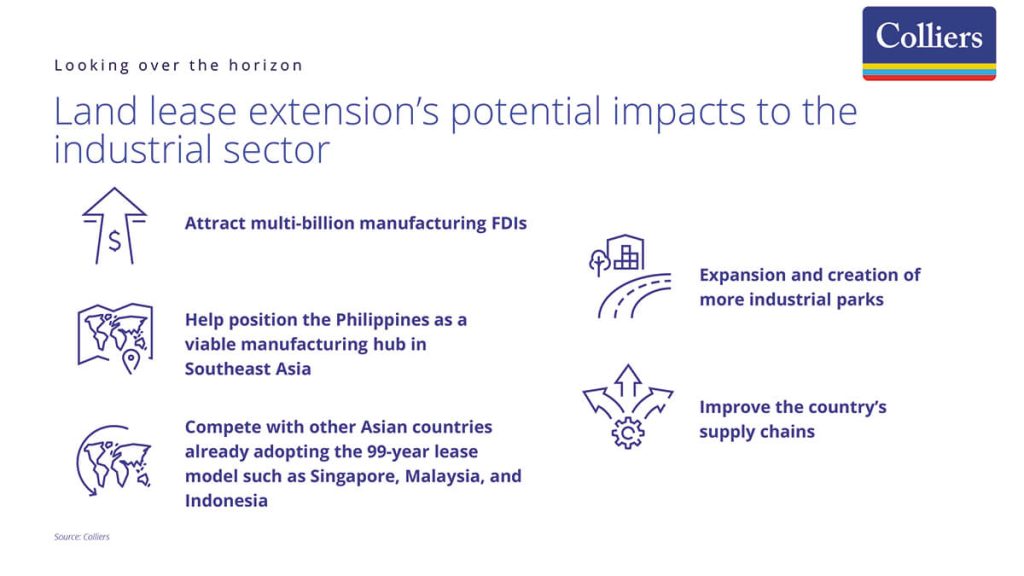

In August 2025, President Marcos signed into law Republic Act (RA) No. 12252, liberalizing the lease of private lands by foreign investors. The law extends the stability of long-term lease contracts for industrial estates, factories, agro-industrial ventures, tourism, agriculture, agroforestry, and ecological conservation from 50+25 years to up to 99 years. In our opinion, the law’s implementation will be crucial in attracting more foreign manufacturers into the country.

Developers with expansive industrial footprints should also take advantage of the entry and expansion of manufacturing locators by enticing them to put up facilities within their industrial parks. With more investments in the country given the land lease term extension, Colliers sees the creation and expansion of more industrial parks in Central Luzon and the Cavite-Laguna-Batangas (CALABA) corridor.

Explore more sunrise industries

Colliers recommends that developers explore sunrise industries such as EVs, a new priority of the Philippine government. We expect sustained interest from EV firms looking for an industrial base in the region. Automated Technology Philippines (ATEC) partnered with Panjit International for a new semiconductor plant for automotives, including EVs. Chinese manufacturer Contemporary Amperex Technology is also exploring local battery manufacturing operations in the Philippines.

In our opinion, the approval of the Electric Vehicle Incentive Strategy (EVIS) should entice more EV manufacturers to set up shop in the country. EVIS provides fiscal and non-fiscal incentives to stimulate local production of EVs and their parts, such as batteries.

Over the near to medium term, the Philippine government should entice other thriving sectors, such as pharmaceutical firms, and encourage them to manufacture in the Philippines.

#PropertyReportFeature

#FeaturedStory