Overseas Filipino Workers (OFWs) continue to keep the Philippine economy afloat. Latest government data show that on average, OFWs send home about USD3 billion in cash remittances every month. Economic analysts and banks are projecting these remittances to grow by about 3-4% per annum over the near term.

Remittances fuel our economy and essentially key segments of Philippine property. The remittance-driven consumption spending particularly benefits retail, hotel, and residential segments.

Remittances fueling property demand

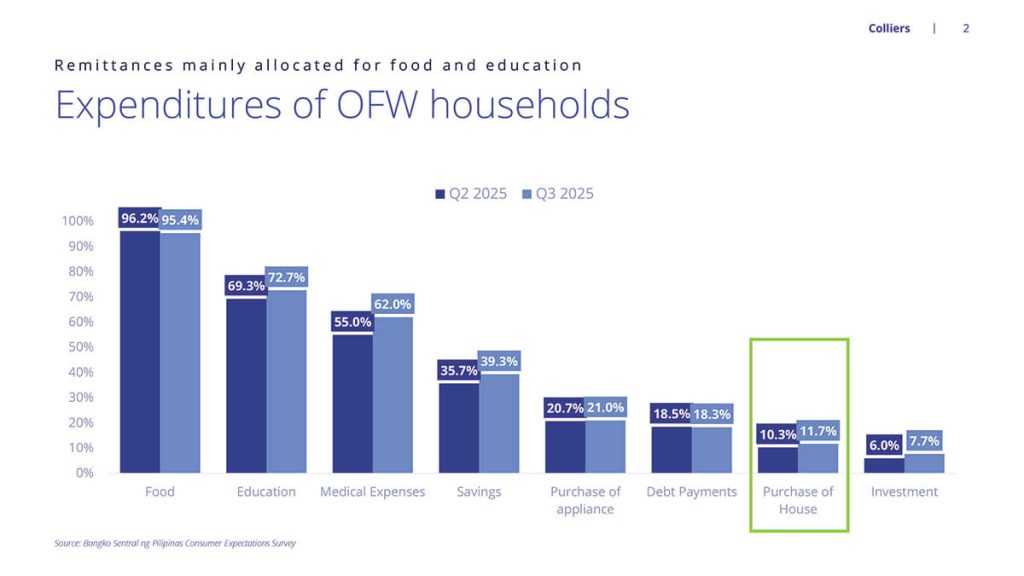

The retail segment is dependent on these remittances as they fuel optimism in a consumption-led Philippine economy. The remittances sent home by Filipinos working abroad drive consumption spending, with the latest central bank poll indicating that more than 90% of remittance-receiving households allocate remittances to food and beverages. This spending partly drives demand for physical mall space and injects much-needed confidence for Philippine retail, which covers online and offline sellers.

The hotel segment also benefits from increased remittances, especially during summer and yuletide season. The remittances partly drive demand for hotel and restaurant spending, especially during peak seasons (summer and Christmas).

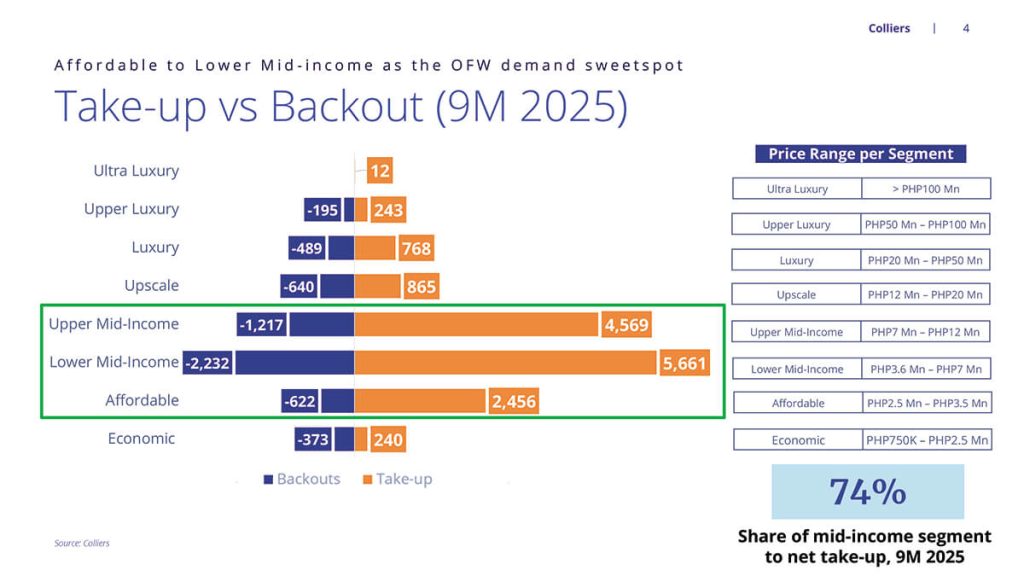

The residential segment is also stoked by money sent home by OFWs. At Colliers Philippines, we always note that the PHP2.5 million to PHP7 million (affordable to lower mid-income) price range is the sweet spot of OFWs’ residential demand. This applies even for key areas outside of Metro Manila, including central Luzon, southern Luzon, western Visayas, central Visayas, northern Mindanao, and Davao region.

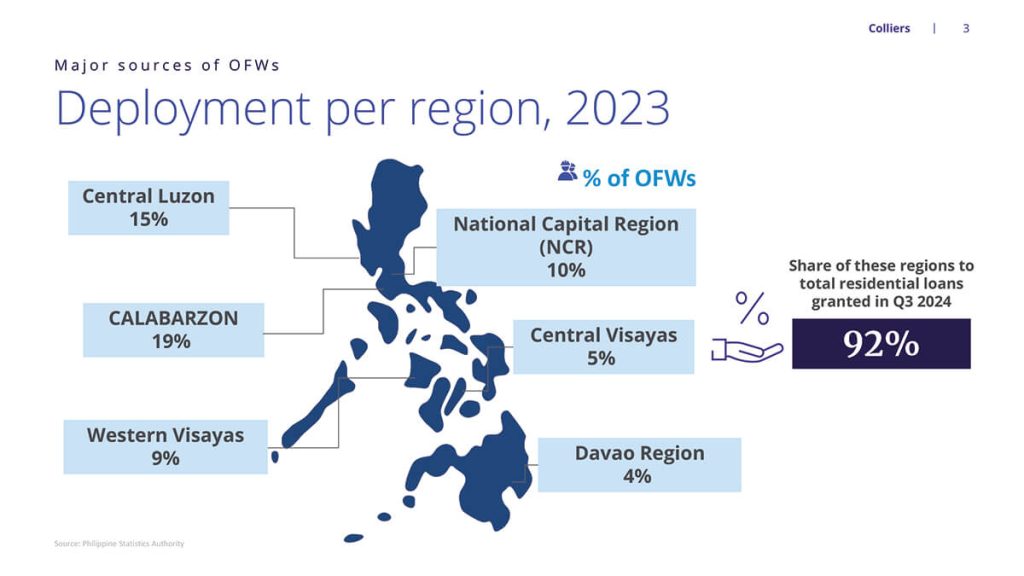

This is pretty understandable given that more than 60 percent of Filipinos deployed for overseas employment are from Metro Manila, Central Luzon, Calabarzon, Central Visayas, Western Visayas, Davao Region, and Northern Mindanao. Colliers is optimistic that OFWs will continue to be a major plank of residential demand within and outside Metro Manila, driven primarily by strong end-user take-up for lot-only and house-and-lot residential developments.

In my case, I was invited by major developers, including Ayala Land, RLC Residences, and Vista Land, to conduct property briefings for their OFW investors. These property previews were an eye-opener and gave me the opportunity to see our fellow Filipinos actually acquiring properties. I also learned the very reasons why they bought residential units–for their children about to enter college, for their retirement, for their long-term investment, as a source of recurring income, etc.

Constantly monitor key demand drivers

Colliers Philippines encourages developers to continue carving out projects outside of Metro Manila that cater to OFW families’ end-user demand. With massive townships being launched left and right, we believe that it is crucial for these masterplanned communities to continue catering to OFW households’ needs, including socialized, economic, and affordable housing units. It is important that property firms continue building these residential projects in regions that significantly deploy Filipinos for overseas employment.

Latest data from the Philippine central bank show that the percentage of OFW households planning to allocate a portion of their remittances for the purchase of a property increased to 11.7% in Q3 2025 from 10.3% a quarter ago. The deployment of more Filipinos for overseas employment and sustained rise in remittances should continue supporting residential demand across the country.

What OFW investors must consider

Buying a property in the right location is key. As we say in real estate, location, location, location. Make sure that you invest in a property that is situated in a location with good rental and price appreciation potential. While being in a masterplanned community has become a popular option, it is also important to choose a location that is near public transportation and infrastructure projects. These are important, especially if you decide to flip or resell your property in the future.

Buyers should look for projects with strong rental and high occupancy prospects once completed. Scout for residential projects that you can lease out to employees, students, and young families once turned over.

Buy from a developer that will produce a quality product on time. If they say they can turn over a unit in five years, they should be able to do so without question. Developers should be able to deliver based on what they promised, including the finish of the residential unit as well as amenities.

Developers are offering attractive and innovative promos right now, whether in the pre-selling or secondary markets. Make sure you look around for the best promo that developers offer. Search also for the bank that offers the best and most attractive mortgage rates and discounts.

#PropertyReportFeature

#FeaturedStory