The Philippine tourism sector continues to face challenges. Foreign arrivals are far from pre-COVID numbers, while infrastructure connectivity to other sites has yet to significantly improve.

But as I mentioned last week, there are opportunities that public and private stakeholders can tap. The fact that hotel occupancies and daily rates are stable despite a drop in international visitors means that there are other markets that the Philippine hotel players can bank on. And just like other property segments, it’s not all doom and gloom for one of the country’s major job-generating sectors.

Stable hotel occupancy in H1 2025

In H1 2025, average hotel occupancy in Metro Manila remained stable at 64% (+1% YOY). In 2025, we project average occupancy to hover at 60%, as international arrivals have yet to return to pre-pandemic levels and a sizeable number of new hotel rooms are expected to come online in H2 2025, putting downward pressure on occupancy and daily rates of 3-star hotels.

Subdued new supply

In H1 2025, Colliers recorded the completion of 97 rooms, with the opening of Novel Hotel Manila in Taguig City. In 2025, we project the completion of 1,100 new rooms, lower than our previous estimate of 2,700 rooms due to construction delays of hotels located in San Juan, Bay Area, and Quezon City. For the remainder of 2025, we expect the opening of Somerset Valero Makati (176 rooms), Alino Hotel New Manila (128 rooms), AC Hotel Ortigas (150 rooms), Vibe Hotel Alabang (144 rooms), Seda Hotel Arca South (265 rooms), and Copeton Baysuites (hotel component) with 140 rooms.

From 2025 to 2027, we project a yearly completion of about 1,700 new rooms. The Bay Area and Quezon City will likely account for more than 50% of the new supply during the period.

ADRs to grow by 6% in 2025

In H1 2025, average daily rates (ADR) grew by 3.7% HOH and 5.1% YOY. Five-star hotels’ average ADRs grew the fastest, rising by 9% HOH. We attribute this to the influx of high-spending and long-staying tourists, including business travelers, as well as tempered completion of new hotels during the period. In 2025, we expect ADRs to grow by 6%, driven by a spike in demand from both domestic and foreign travel markets. We see this ADR growth being sustained by the staging of major global and local events for the remainder of 2025. The second half of each year is also a traditionally robust period due to corporate events and the influx of returning OFWs.

First mover advantage for big foreign brands

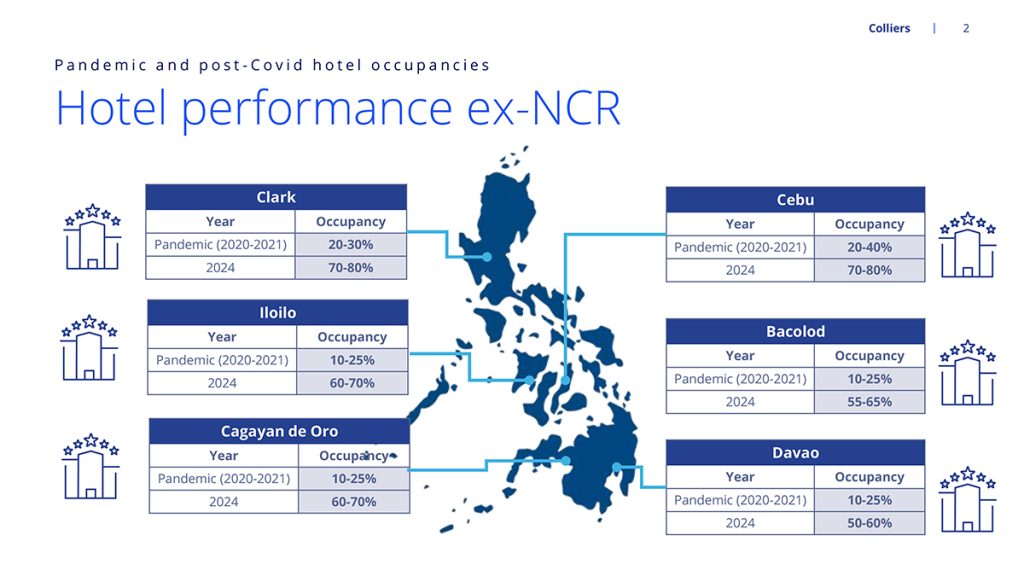

Colliers encourages developers to partner with foreign brands and look at building hotels in thriving tourist destinations across the country. Among the developers that have expressed interest in expanding their hospitality footprint include Italpinas Development Corporation (IDC), which partnered with Dusit International in launching Dusit Princess Firenze Cagayan de Oro and Dusit Princess Bukidnon; Damosa Land and Wyndham Hotels & Resorts TRYP by Wyndham Hotel Samal in Davao; Tytans Properties and Accor’s Pullman Mactan Cebu Hotel & Residences; AppleOne Properties and Marriott International’s JW Marriott Panglao in Bohol; and Cebu Landmasters Inc. and The Ascott Group’s Citadines Paragon Davao. The Four Seasons brand has also expressed interest in opening a hotel in the Philippines.

Aside from the traditional hotspots, local developers and foreign brands should seriously consider building new facilities in emerging hubs with tremendous potential for growth.

We are seeing a relentless expansion of foreign hospitality brands in the Philippines. The travel and tourism sector has tremendous potential given the projected rise in arrivals and the modernization of airports across the country. Definitely, there’s more to explore in the Philippines, which should give foreign and domestic travelers alike more than 7,600 reasons to love the Philippines.

For feedback, please email [email protected]

#PropertyReportFeature

#FeaturedStory