This is the conclusion of my piece for the Property Report. I already discussed how tenants and landlords are recalibrating to capture demand in a constantly evolving Metro Manila office market. So far, we are seeing muted launches and stifled pre-leasing, while tenants and developers scramble to reimagine the use of office space just to entice more employees to return-to-office (RTO).

It’s interesting to see that residential developers and investors are tweaking to latest trends in the market and are proactively responding to constantly evolving preferences of end users and investors. These are reflected in the latest survey report released by Colliers Philippines.

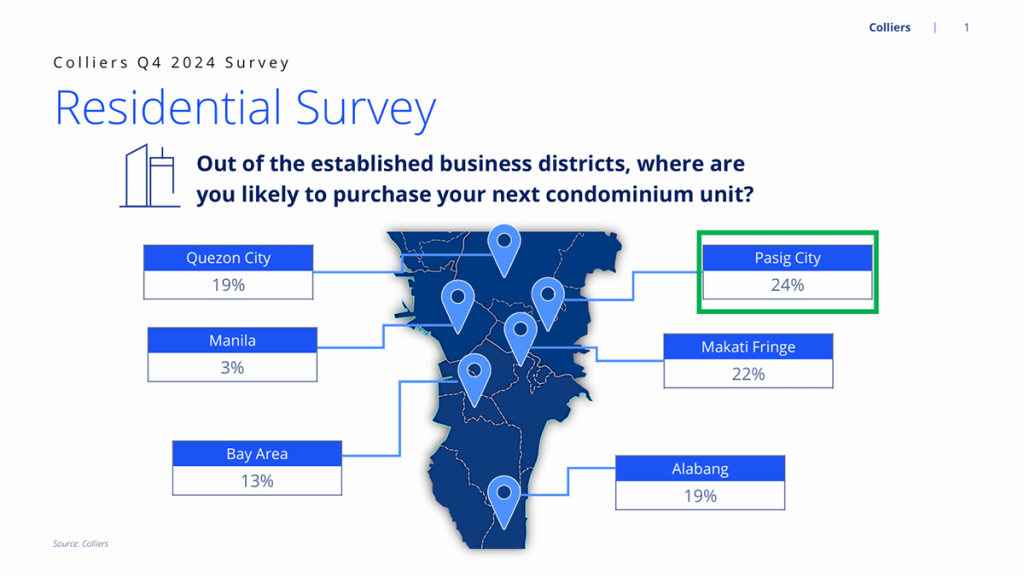

Outside of Makati CBD, Fort Bonifacio and Ortigas Center, condominium buyers are also eyeing fringe locations. This is particularly true for peripheral areas outside of the more established business districts where developers offer attractive and extended payment terms for ready for occupancy (RFO) condominium projects.

Pasig remains as the preferred location for residential investment outside of the more-established business districts, followed by Makati Fringe, Quezon City, and Alabang. As of end-2024, these submarkets accounted for 40% of the total unsold RFO inventory in Metro Manila. We encourage buyers to scout for attractive RFO payment terms in these sublocations while we recommend that developers highlight their flexible RFO terms for end-users and investors.

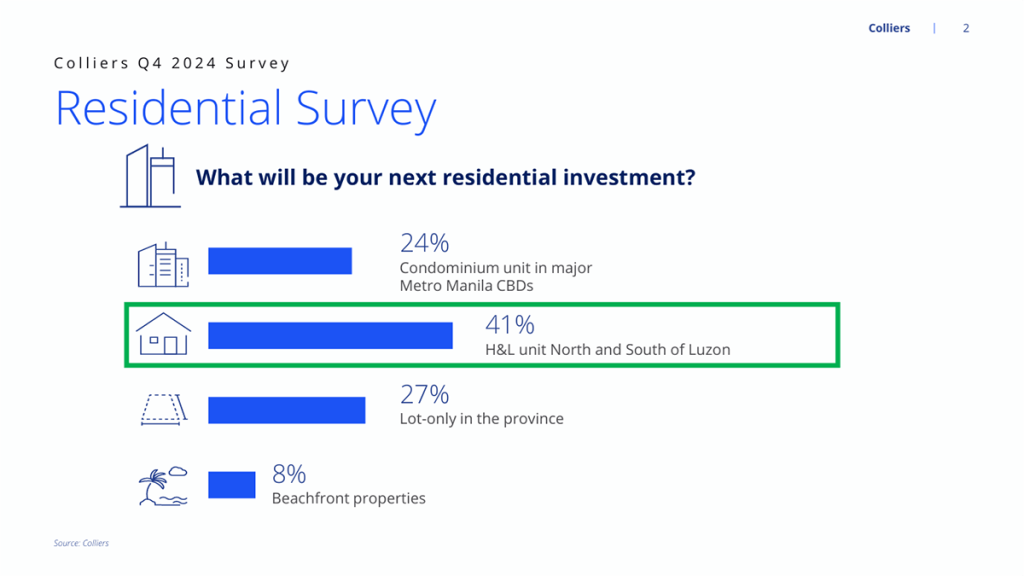

It is also interesting that when asked about their next residential investment, close to 70% of our respondents chose house-and-lot (H&L) or lot-only units in North or South Luzon for their next residential investment. Among the most attractive sites in these regions are Cavite, Laguna, Batangas, Pampanga, Bulacan and Tarlac. H&L projects in these property hotspots recorded an average annual price increase of 3% to 6% from 2016 to 2024.

Meanwhile, 8% of our respondents said they are planning to acquire beachfront properties. National players should seize the rising demand for condotels and take advantage of the rising influx of international tourists, a potentially gargantuan market for resort and leisure-themed condominium developments.

The sweeter ready for occupancy (RFO) promos have also been stoking the appetite for residential units within Metro Manila. Admittedly, the vertical market in Metro Manila has been seeing some challenges because of elevated mortgage rates and the exodus of offshore gaming employees from China.

As of end-2024, total unsold condominium inventory in Metro Manila reached 74,400 units. Colliers recommends that developers offer more attractive and curated promos, particularly those with a substantial amount of RFO units. A number of property firms have been offering early move-in promos and discounts for their RFO units. Some property firms have also been open to having their condominium units leased for up to 36 months, then giving the ‘renters’ the option to buy the units after the extended ‘lease’ period.

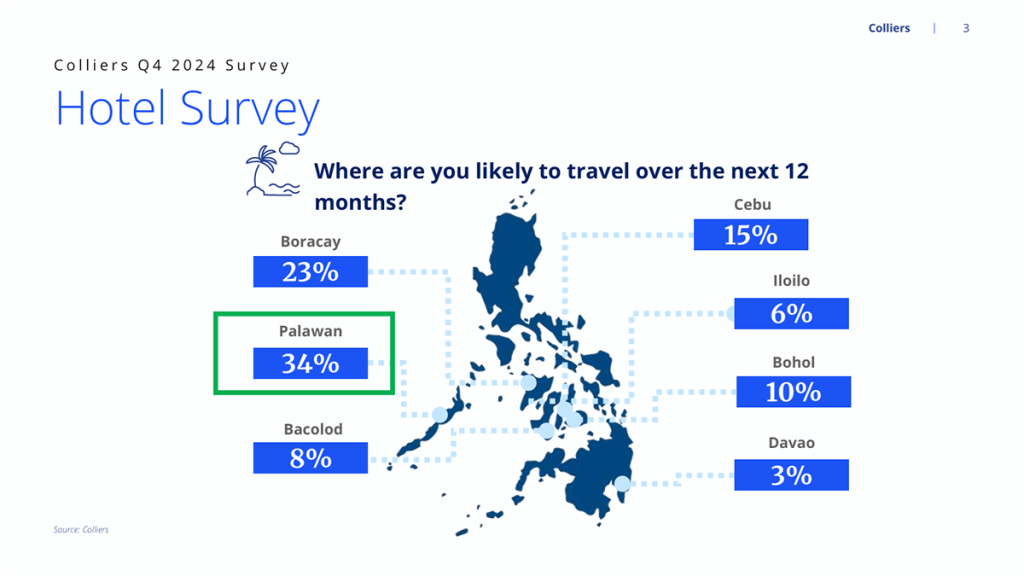

For the leisure sector, Palawan has consistently ranked as the preferred destination of our respondents. During our Q2 2021 poll, Palawan was the top choice, being chosen by 43% of our respondents. More than 3 years since our first survey, Palawan re-emerged as the preferred destination, followed by Boracay (23%) and Cebu (15%). Meanwhile, Bohol captured 10% of the total votes. In 2024, Palawan ranked 13th among the 25 locations included in the Travel+Leisure’s 2024 World’s Best Islands list. In 2025, Palawan was also shortlisted for this year’s awards alongside Panglao Island in Bohol, Mactan Island in Cebu and Boracay Island in Aklan.

Among the developers with presence in Palawan include: Megaworld, Filinvest Land, Robinsons Land, Sta. Lucia Land, Vista Land, and Ayala Land.

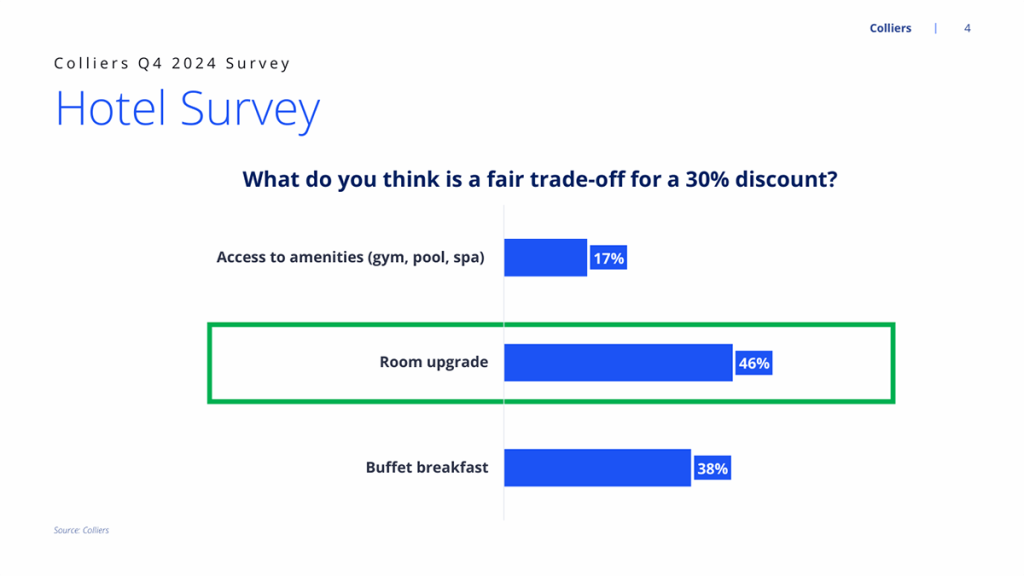

Interestingly, when asked about a fair trade-off for a 30% discount, about 46% of our respondents prefer room upgrade as a fair trade-off for a 30% discount on room rate, followed by buffet breakfast at 38% and access to amenities at 17%.

Colliers encourages hotel operators to create curated packages and promotions to lure more guests into their properties. This may be done through guest profiling as long-staying business travelers may prefer room upgrades while short-staying leisure travelers might opt for free buffet breakfast and free access to hotel amenities.

It is worth mentioning that the property market continues to evolve. There will be winners and losers. The bottom line: developers need to be agile in a constantly evolving Philippine property market.

#PropertyReportFeature

#FeaturedStory