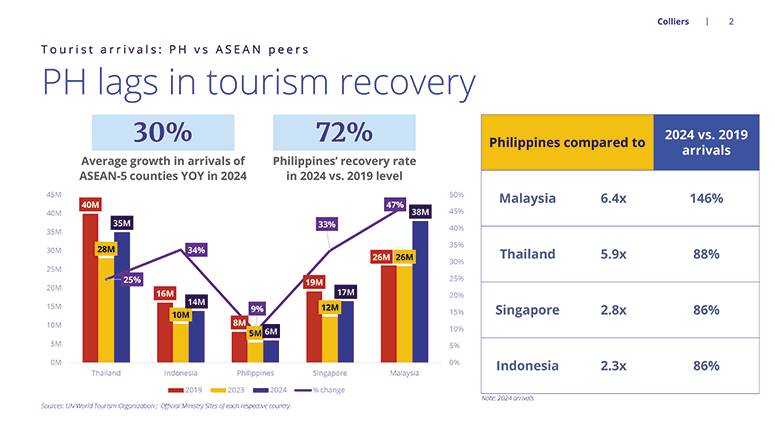

The Philippine travel and tourism sector continues to attract major hospitality brands. This is primarily due to the sector’s growth potential especially given the Marcos administration’s plans to rehabilitate and modernize airports across the country. International arrivals increased in 2024 although the total figure is lower than the government’s target. The Tourism department remains optimistic as it banks on the growth of traditional and non-traditional source markets to fill the huge void left by Chinese tourists.

Data from the Department of Tourism (DOT) showed that international arrivals reached 5.95 million in 2024, up 9.2% from the 5.45 million recorded in 2023 but unable to breach the government-projected 7.7 million arrivals. South Korea remained to be the country’s top source market with 1.6 million arrivals, followed by the United States, Japan, China and Australia. Despite lackluster arrival figures, the DOT reported that tourist receipts reached a record-high PHP760 billion (USD13.1 billion), up from PHP600 billion (USD10.3 billion) in 2019, which indicates that tourists are now spending more and staying longer. The Philippines ranked the highest in Southeast Asia with an average expenditure per arrival of USD2,073 (PHP122,000) for an average 11-night stay.

Meanwhile, the New NAIA Infra Corp. (NNIC) reported that the Ninoy Aquino International Airport (NAIA) ended 2024 with a record-breaking passenger volume of 50.1 million, up 10.1% from a year ago and breaching its 35 million capacity. The Clark International Airport (CRK) also recorded a 20% growth in passenger volume YOY, serving 2.4 million passengers in 2024.

Improving hotel occupancy

In H2 2024, average hotel occupancy in Metro Manila reached 64%, slightly higher compared to the 63% recorded in H1 2024. In 2024, occupancy reached 64%, up from the 63% average a year ago partly due to the influx of tourists during the holiday season. In 2025, we expect occupancies to remain stable as the projected increase in foreign arrivals will likely complement the opening of new hotel rooms in the capital region.

Delayed completion to raise new supply in 2025

In 2024, Colliers recorded the opening of 2,700 new hotel rooms, the same level as 2023, but lower than our initially forecasted completion of 4,500 rooms due to construction delays. Among the new hotels that opened during the period were Citadines Roces (200 rooms), Ibis Styles Manila Araneta City (286 rooms), Solaire North (526 rooms), Hop Inn North EDSA (187 rooms) and The Grand Westside Hotel (1,530 rooms). In 2025, we project the completion of 2,680 rooms, with the Bay Area, and Makati CBD covering nearly half of the new supply.

Among the hotels likely to open in 2025 are: Somerset Valero Makati, Keyland New Manila Hotel, Fili Hotel Bridgetowne, Citadines Greenhills Manila, Seda One Ayala, Westside City Resorts World, and AC Hotel Ortigas. From 2025 to 2027, we expect the annual delivery of 1,600 rooms, lower than the 2,200 rooms completed annually pre-Covid or from 2017 to 2019.

Hotels as attractive REIT assets

In our opinion, hotel REITs are an attractive option for developers especially given the revival of the travel and tourism sector post-Covid and the modernization of major airports. Developers such as Ayala Land have already infused some of their hotel assets into their REIT portfolio. DoubleDragon Properties and Filinvest Land have also expressed interest in adding some of their hotels into their respective portfolio.

Colliers encourages developers to further explore the viability of hotel REITs especially given the bright prospects for the Philippine travel and tourism sector.

Maximize improving infrastructure backbone

Developers have been constructing new hotels outside the capital region to take advantage of the surge in travel demand from both local and international tourists. Some of the new hotels in the pipeline include those in Baguio, Davao, Bacolod, Cebu, Bohol, Cagayan de Oro, and Clark in Pampanga. In our view, hotel operators should also monitor the construction and upgrading of airports across the country. These newly built and modernized airports should help guide to developers as to where they should build next – hotels, MICE facilities, and other relevant establishments.

We are seeing a relentless expansion of foreign hospitality brands in the Philippines. The travel and tourism sector has tremendous potential given the projected rise in arrivals and modernization of airports across the country. Definitely, there’s more to explore in the Philippines which should give foreign and domestic travelers alike more than 7,600 reasons to love the Philippines! – With Alfonso Martin Aguila Senior Research Analyst, Colliers Philippines

For feedback, please email [email protected]