(Second of three parts)

The Metro Manila condominium market continues to see challenges, as I highlighted in my previous column last December 20. In our view, property developers need to remain agile as they navigate through the challenges in the property market.

Maintaining the status quo just won’t cut it. From extending downpayment terms to implementing more innovative promos to ramping up residential towers’ amenities and facilities, developers need to be proactive to fully capture the market’s recovery in 2025.

Continue offering attractive promos and payment schemes

During the peak of the pandemic, we have observed developers offering attractive and innovative promos to address the lukewarm demand in the pre-selling market. Some have given discounts of up to 15% on spot cash payments in select projects. Other developers have offered lower reservation fees, and free items such as appliances, furniture, and gadgets.

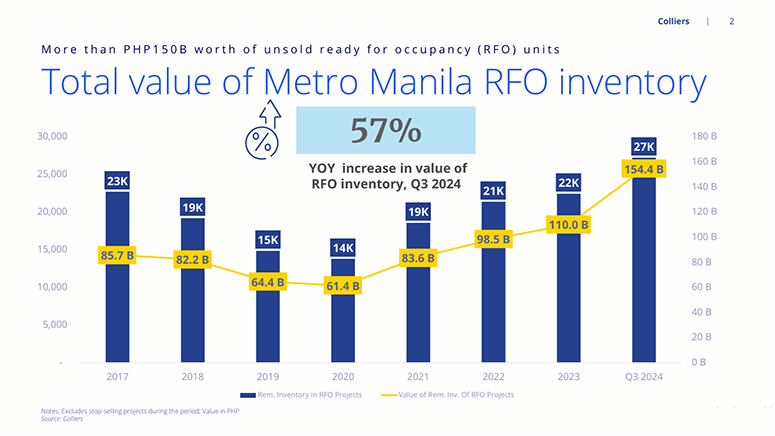

Colliers recommends that developers remain aggressive in offering promos and revisit their payment schemes, especially with still sizable number of RFO units in Metro Manila. We are seeing extended downpayment terms of up to 84 months for some newly-launched projects. Colliers believes that affordable amortization and extended payment terms should help reignite residential appetite from investors and end-users.

Offering upgraded amenities and facilities should be the norm

Aside from carving out of flexible workspaces within residential developments to entice interest from professionals that work under hybrid arrangements (mix of office and traditional office setup), Colliers believes that developers should continue promoting the upscale amenities and facilities that they offer within their residential developments, whether vertical or horizontal. As Colliers previously highlighted, proximity to infrastructure and institutional establishments such as schools and hospitals will remain crucial in stoking residential appetite in the market. This should be complemented by additional features such as resort-like pools, modern and well-equipped gyms, yoga facilities, garden gazebos, as well as electric vehicle (EV) charging stations. In some condominium projects, developers have taken the lead in highlighting sustainable features.

Developers should also consider integrating green technologies (GreenTech) to differentiate their projects in the market. These include natural lighting, optimized air quality, and rainwater catchment facilities. We also encourage developers to adopt sustainable features with the inclusion of green spaces such as vertical gardens in their upcoming projects. Property firms should also take a more aggressive stance in introducing artificial intelligence (AI) technologies into their residential projects. Colliers also believes that the launch of more property technology (proptech) features will be the norm moving forward. A number of developers have incorporated built-in fiber optic internet connection, videoconferencing areas, and flexible workspaces that are suited for work-from-home (WFH) or hybrid working arrangements. We also encourage developers to highlight amenities such as open spaces and activity areas.

More attractive promos to complement rate cut

Colliers believes that the Philippine central bank’s decision to reduce basic interest rates is likely to help revive demand in the residential market. The Philippine central bank recently reduced policy rates by another 25 basis points, lowering interest rates to 5.75%. Colliers believes that this will not immediately result in lower mortgage rates, but we recommend that developers sustain or even sweeten their current promos to resuscitate the currently tepid take-up in the Metro Manila pre-selling condominium market.

Meanwhile, Colliers encourages investors to actively monitor interest and mortgage rates, particularly as these strongly influence the viability of residential investment. Interest rates should guide developers with their promos and payment schemes. Given the substantial unsold inventory in the secondary market (which is likely to take more than five years to be fully absorbed by the market from the previous 12 months annually from 207 to 2019), developers should be proactive in offering leasing and early move-in promos for RFO projects, and we are already seeing some developers being aggressive in offering early move-in and rent-to-own schemes for their RFO units. A couple of developers are even allowing buyers to move in with a down payment of as low as 2.5%, and discounts of as much as 25% of Total Contract Prices (TCPs).

Ramped up launch of leisure-themed projects and golf communities outside Metro Manila

Colliers believes that developers should cash in on the thriving demand for resort or leisure-oriented properties outside Metro Manila. Among the property firms that already offer leisure-themed developments outside Metro Manila include Brittany, DMCI, Rockwell, Megaworld, Ayala Land, Robinsons Land, Cebu Landmasters, and Damosa Land with projects located in Cebu, Davao, Bohol, Palawan, and Batangas. National players should seize the rising demand for condotels and take advantage of the rising influx of international tourists, a potentially huge market for resort and leisure-themed condominium developments.

Colliers also sees the revival of demand for golf communities within and outside Metro Manila. Among the developers that launched new golf communities include Rockwell, Vista Land, and Megaworld, while Sta Lucia remains as one of the biggest developers of golf communities across the country. In our view, golf communities with vertical residential developments are likely to garner interest from local and foreign travelers (including retirees), while horizontal projects within these estates are likely to corner take-up from domestic travelers and investors.

To be concluded next week.

* * *

For feedback, please email [email protected]