Property Report recently attended the Full Year 2024 Philippine Property Market Report hosted by Leechiu Property Consultants (LPC). The event showcased comprehensive insights into the country’s real estate sectors, with Mikko Barranda, Director of Commercial Leasing at LPC, discussing updates on the office market, while Roy Golez, Director of Research and Consultancy, shed light on the dynamic growth of data centers.

Office Leasing: Steady Growth Amid Challenges

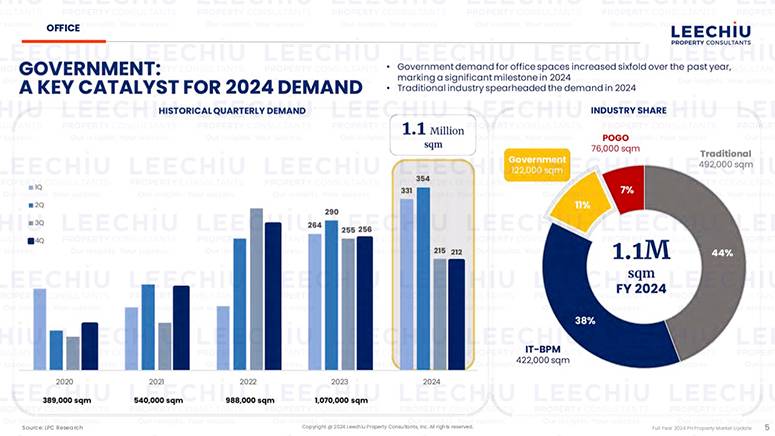

In 2024, the Philippine office leasing market recorded 1.1 million sqm in transactions, a 4% year-on-year increase, marking the highest transaction volume since the pandemic. Despite challenges such as high interest rates, inflation, and the Philippine Offshore Gaming Operators (POGO) ban, the traditional sector surged, contributing 492,000 sqm—up 13% from 2023. Government expansions in the Bay Area further bolstered demand, adding 122,000 sqm.

Mikko Barranda highlighted that Metro Manila led with 881,000 sqm of total leasing activity, driven by transactions in Bonifacio Global City (BGC) and the Bay Area. Cebu, the leading provincial market, accounted for nearly half of the 113,000 sqm recorded outside the capital.

Vacancy rates nationwide stood at 18%, reflecting the market’s transitional phase. However, contractions, primarily from POGO exits, were offset by IT-BPM firms relocating and consolidating rather than downsizing. Net demand totaled 1.4 million sqm, underscoring the market’s resilience.

Looking ahead, active office space requirements of 494,000 sqm, driven by government expansions and third-party IT-BPM vendors, highlight the sector’s optimistic trajectory for 2025. Experts anticipate stabilization by 2027, with vacancy rates potentially returning to pre-pandemic levels of 7% by 2030.

Data Centers: A Sector on the Rise

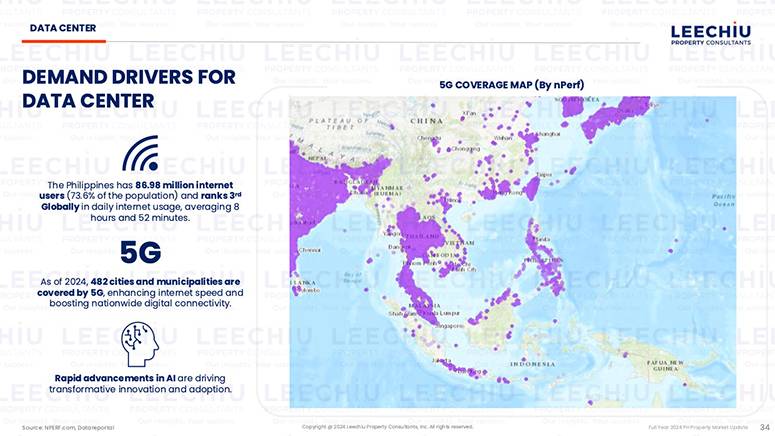

Roy Golez presented an optimistic outlook for the Philippine data center industry, which is undergoing rapid transformation, spurred by increasing digital infrastructure investments, the adoption of 5G technology, and advancements in artificial intelligence. In 2024, the sector’s total power capacity reached 182.2 MW, led by ePLDT with 122 MW and Globe with 35.2 MW. An additional 161 MW is expected by 2025, reflecting sustained investor confidence.

The National Capital Region hosts 11 data centers, while secondary markets like Cebu and Davao are emerging hubs, each with multiple facilities. Despite lagging in per capita capacity compared to regional peers like Malaysia and Singapore, the Philippines boasts significant growth potential, backed by government incentives and private sector investments.

An estimated 1,364 MW of additional capacity is in the pipeline, positioning the country as a strategic location for global data center expansion. This trajectory underscores the Philippines’ critical role in the evolving digital economy.

Looking Ahead to 2025

Both sectors are primed for growth, with office leasing focusing on meeting demand from government and IT-BPM expansions, while data centers capitalize on rising digital infrastructure needs. “Although vacancies remain elevated at 18%, supply and demand trends indicate that the market is shifting toward equilibrium, with clearer signs of recovery expected by 2027,” remarked Mikko Barranda during his presentation.

The alignment of public and private sector efforts will play a crucial role in driving this momentum, ensuring the Philippines remains competitive in real estate and digital infrastructure.