(First of three parts)

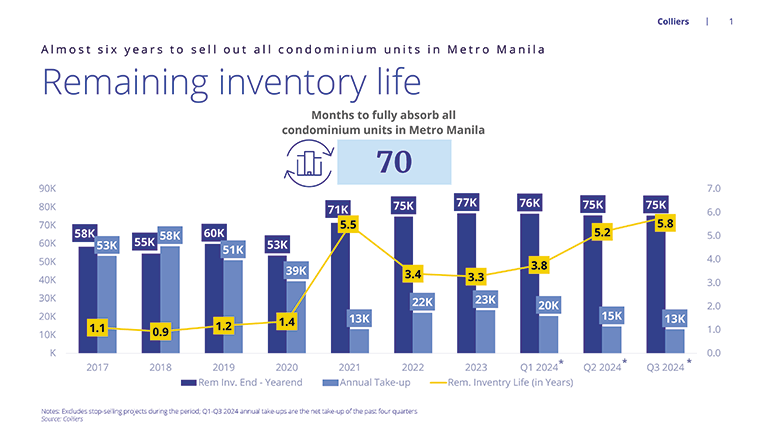

We are seeing stifled completion of new condominium units in Metro Manila. Tempered new launches would mean tempered take up particularly for condominiums in Metro Manila given the sizeable number of unsold pre-selling and completed/ready for occupancy (RFO) units right now in the capital region. We estimate that will take more than five years for these unsold units to be absorbed by the Metro Manila market.

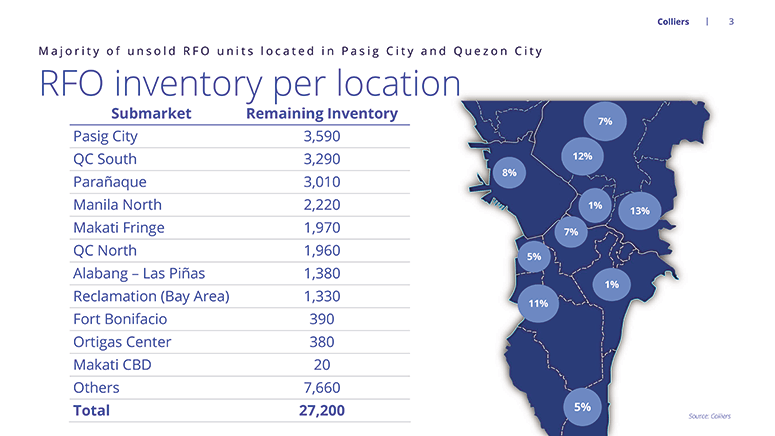

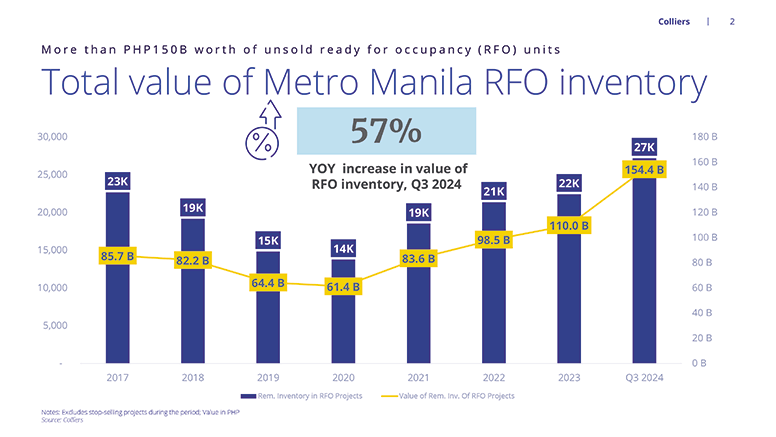

Colliers believes that the substantial amount of unsold RFO units is constricting developers to launch new condominium projects in the capital region. As of Q3 2024, Colliers data showed that unsold inventory in Metro Manila (covering pre-selling and ready for occupancy or RFO) reached 75,300 units. It will take about 5.8 years to fully sell out all these unsold condominium units, about five times longer compared to the pre-pandemic period (2017 to 2019) where remaining inventory life (RIL) ranged between 0.9 and 1.1 years. Of the 75,300 remaining inventory, 27,200 are ready-for-occupancy (RFO) valued at PHP154.4 billion (USD2.8 billion).

Colliers believes that there are opportunities in the residential market and these are the positives that developers should seriously consider moving forward.

Explore more JVs for upscale to luxury projects

In our view, developers planning to launch projects within the upscale to luxury price band should consider joint venture (JV) deals either with local players or foreign developers. These partnerships should be beneficial to property firms with limited landbank as well as to those that intend to offer upscale to luxury and even ultra-luxury residential projects. As of end-Q3 2024, Colliers data showed that joint venture luxury projects in Metro Manila have take-up rates of between 40% and 100%.

Despite being the most expensive in the market, these projects are doing relatively well. We attribute this sustained take up to an upscale and luxury market that remains awash with cash and continues to bank on condominium projects’ capital appreciation potential.

Highlight condominium units’ price appreciation potential

Colliers Philippines believes that the investor market in Metro Manila continues to rely on condominium units’ capital appreciation potential. In our view, developers should be aggressive in highlighting the residential segment’s viability as a potential hedge against inflation. Vertical units that are located in integrated communities and near public infrastructure projects also have great capital appreciation potential and this should be among investors’ key considerations when acquiring a condominium unit.

New projects in key areas outside NCR (AONCR)

Horizontal projects remain attractive especially among end-users and Filipinos working abroad. We encourage developers to consider the viable locations for house-and-lot (H&L) and lot-only projects including provinces in CALABARZON, Central Luzon, Central Visayas, Western Visayas, and Davao region. H&L projects in these property hotspots recorded an average annual price increase of 4% to 7% from 2016 to 2023. Lot-only developments, meanwhile, recorded stronger price appreciation during the period, ranging between 7% and 15% annually from 2016 to 2023.

Previous Colliers polls also showed the attractiveness and viability of these locations. These regions are also among the major recipients of remittances from Filipinos working abroad, covering more than half of the 2.16 million deployed Filipino workers in 2023. The steady inflow of remittances also ensures stable demand for residential end-use.

Additionally, data from the Philippine central bank showed that these regions also accounted for a combined 63% of total residential real estate loans granted by Philippine banks in Q2 2024.

New infra remains pivotal

The infrastructure projects implemented by the Philippine government should redefine and redirect developers’ expansion strategies. The construction of key public projects especially in prime property destinations outside of the capital region should provide access to properties that can be redeveloped into massive integrated communities. These townships offer a mix of vertical and horizontal projects. Due to road projects, for instance, business opportunities have spilled over to nearby areas such as Cavite, Laguna, and Batangas. In other parts of Luzon, Pampanga, Bulacan, and Tarlac remain attractive options for property firms.

This has been evident especially with a more pronounced launch of townships in these provinces. Outside of Davao and Cebu, growth areas in Visayas and Mindanao include Bacolod, Iloilo, and Cagayan de Oro. These cities and provinces are among those that will likely benefit from the government’s massive infrastructure push even beyond President Marcos’ term.

Among the new projects lined up for completion in these localities include the New Manila International Airport, Davao Airport Expansion, MRT-7, North-South Commuer Railway (NSCR), Metro Cebu Expressway, and Panay-Guimaras-Negros Bridge. Because of these massive public projects, developers such as Rockwell Land, Ayala Land, Megaworld, Filinvest Land, DMCI, and Cebu Landmasters have aggressively and strategically landbanked in these areas. Megaworld, for instance, is setting aside PHP100 billion (USD1.7 billion) in the next four years to capitalize on the Marcos administration’s thrust of building infrastructure that will benefit the tourism sector. In the next few years, we see developers taking advantage of this improving infrastructure connectivity to launch more leisure-centric projects.

From Build, Build, Build to Build, Better, More, we believe that these public projects will continue to play a central role in dictating developers’ expansion strategies outside of Metro Manila. Infrastructure will remain a game changer for property developers and investors.

To be continued.

* * *

For feedback, please email [email protected]