Central Luzon, strategically positioned in the heart of the Philippines, is emerging as a significant player in the country’s office market landscape. It benefits from its proximity to Metro Manila and has become a major focus in the country’s efforts to push development outwards to the countryside. The area’s talent availability and infrastructure development, including the expansion of major highways and the construction of new business districts, further enhance the region’s appeal.

Similarly, South Luzon is also seeing this trend with its mixed-use developments attracting demand from occupiers looking to expand into its talent-rich provinces.

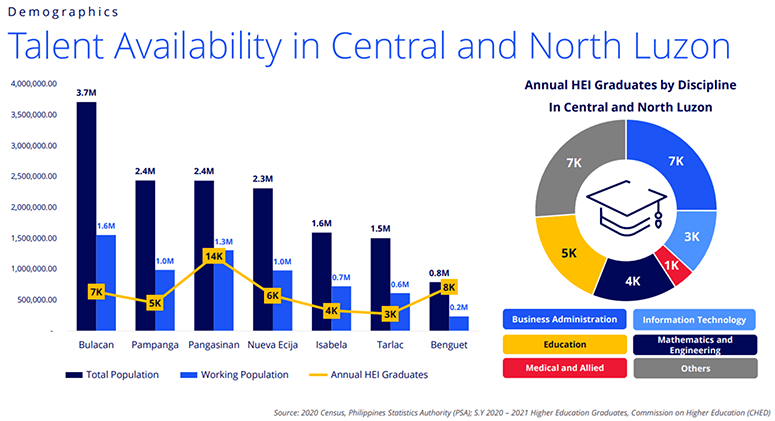

Talent is everywhere in Luzon

Talent in Central Luzon (even further up north) abounds with provinces like Bulacan, Pampanga, Pangasinan, and Nueva Ecija offering a working population in the millions including a high level of higher education graduates. These are populations that, for the longest time, have sought opportunity in the capital region by enduring long commutes or taking up rental spaces closer to work and going home during the weekends.

South Luzon’s major provinces also compete with its population in Cavite, Laguna, and Batangas in the millions with a high number of annual graduates, especially Batangas with 11,000 graduates per year.

Office – a different ballgame in the countryside

With the provinces rich in talent, it is no longer surprising that Business Processing Outsourcing (BPO), particularly Third-Pary Outsourcing (3PO) companies have sought opportunities in the countryside to tap larger pools of talent.

This has shaped the provincial office market into something much different from what we usually see in Metro Manila where traditional firms are the leading demand drivers. On the other hand, we see BPOs as the main demand driver in provincial markets as they seek of more competitive real estate costs while staying away from saturated markets that make recruiting new talent more challenging. As of H1 2024, total provincial transactions have grown YoY from 88,000 sqm to 122,000 sqm which proves BPO companies’ continuous interest in pursuing expansion in the provinces.

Pampanga is the second largest in terms of 3PO transactions after Cebu and this can be attributed to its proximity to the capital (a 2-hour drive); mature infrastructure in Clark and its environs; international access especially with the newly modernized and expanded Clark airport, and a large and skilled population.

The future is bright for the Central Luzon office market

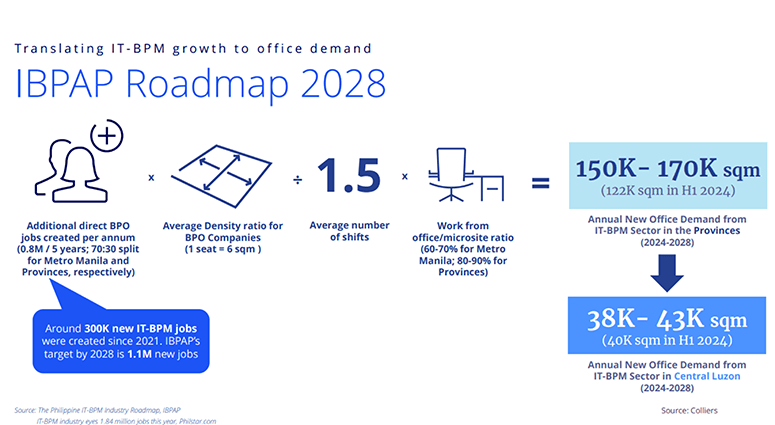

According to IBPAP’s IT-BPM Roadmap 2028, the industry is setting its sights on 2.5 million employees by 2028 after closing 2023 at 1.7 million in headcount. This will translate to more jobs and consequently more demand for space. Using IBPAP’s projected annual increase in headcount of 48,000 per annum in the provinces and the current share of office market transactions, we estimate about 38,000-43,000 sqm in annual new office from this sector in Central Luzon alone from 2024-2028. Given that provincial transactions YoY have grown from 88K sqm last year to 122K now, we’re seeing that the share of Central Luzon office transactions is set to hit that 38K-43K sqm range or, at best, even exceed, this target by end-2024.

Supply gaps exist in talent-rich areas in Central and Northern Luzon

Despite the level of growth and promise in Central Luzon, there remain gaps that should be addressed to better accommodate growth in the future. A lack of quality office supply outside Pampanga designed for BPO operations has been a perennial problem. BPO locators follow where the talent leads them, and they have adjusted their operations to suit unconventional locations in efforts to better reach their employees and remain competitive. To accommodate this, some malls and retail spaces were converted into office spaces to serve BPO operations. This also partly explains why there isn’t brisk level of transactions comparable to what we are seeing in Pampanga. Colliers encourages landlords to look into these untapped locations and develop properties that can suit BPO operations to capture the future demand. Although there are mixed-use developments already available in Central Luzon, developers could take a page out of the South Luzon market by planning mixed-use developments to attract more demand.

In summary, Central Luzon is emerging a significant player in the office landscape but much of this growth has been focused on Pampanga. South Luzon areas are seeing a similar trend but at a lower level due to limited supply compared to their northern and central counterparts. With abounding talent in Luzon provinces, there is no doubt that BPOs have these locations on their radar, and they should continue pursuing expansions to decentralize development outwards from the capital.