One Hundred Seventy Years is a mighty long time. Very few companies have survived the test of time and withstood over 100 years of global and domestic recessions, world and civil wars, political unrests, and pandemics. As the first bank in Southeast Asia, the Bank of the Philippine Islands (BPI) was founded in 1851, ten years before the birth of our National Hero Jose Rizal.

It emerged from the rubble of the Spanish-American War and the Japanese invasion. It survived the tumultuous period of martial law and coups d’ etat in the ‘80s to early ‘90s. It remained financially sound amidst the Asian financial crisis in the late 90s and the global financial crisis of 2008. Be it the Spanish flu, SARS or COVID-19, BPI has stood by its post as a symbol of stability and strength.

I would hazard to say that in no other industry are trust and integrity of greater importance as in banking. Ask yourself, to whom would you entrust your hard earned money?

It is no wonder that banking is one of the most heavily regulated industries. Central banks in each country have laid out extensive regulations to protect depositors – from reserve requirements, deposit insurance, customer due diligence to collateral values and credit provisioning to liquidity and capital position to anti-money laundering laws. Banks also go through at least three audits in a year – internal audit, external audit and central bank audit. The web of coordination and supervision of central banks around the world is a manifestation of the ubiquity and importance of money.

As BPI celebrates its 170th year, we unveil the not-so-hidden secrets behind the bank’s longevity and strength. We can sum these up to G.R.I.T.

I came across the published work of University of Pennsylvania’s Psychology professor, Angela Duckworth in a book called Grit: The Power of Passion and Perseverance.

She defined grit as “passion and perseverance for very long-term goals. Grit is having stamina. Grit is sticking with your future, day in and day out, not just for the week, not just for the month but for years. And working really hard to make that future a reality. Grit is living life like it’s a marathon, not a sprint.” In her years of research, she found out that “as much as talent counts, effort counts twice.”

Reflecting on this, I realized that G.R.I.T. also applies to organizations and it certainly is the same formula that allowed BPI to survive and thrive for 170 years and beyond.

Growth mindset

I don’t think there’s any business that starts without the aspiration of succeeding and growing. Even well-established companies aim to constantly improve market performance and seek new opportunities to expand. Yet, with this ambition and success, dangers of complacency and arrogance can set in that will have repercussions on an organization’s ability to grow.

Having a growth mindset requires humility – the belief that there is always room for improvement. From humility emerges the passion to listen and to learn. In BPI, we constantly seek to understand and listen to the voice of our customers – good and bad. We have invested significant resources to ensure customers come first and for this to drive every employee’s work. In fact, net promoter scores and customer satisfaction ratings are part of an employee’s key performance metrics.

We also believe in building a learning culture because our clients look to us for expert advice. This goes beyond formal training seminars. We are attuned to new trends, new technologies and new business and service models, and to the global and domestic conditions that impact the banking industry and our products and services. By doing so, we have been able to stay ahead of economic and industry cycles.

BPI’s 170-year history has been a story of growth. The mergers with People’s Bank in 1974, CityTrust in 1995, Far East Bank in 2000, DBS in 2002, Prudential Bank in 2005 and the latest being the proposed merger with wholly owned subsidiary BPI Family Savings Bank have been great stories of consolidation of complimentary businesses that benefit customers.

The expansion to emerging cities in the country began way back in 1897 when BPI expanded in Iloilo to support the development of the sugar industry and in 1912 the second branch in Zamboanga was opened, establishing BPI’s presence in the 3 major islands of the Philippines. Since then, BPI has been opening new markets, setting up a branch in emerging cities and establishing partnerships with remittance centers abroad to serve the needs of overseas Filipinos.

Risk management

BPI understands its stewardship role in the economy. You can say that it is in BPI’s DNA to be the beacon of financial stability as it carries the responsibility of having taken on the roles of central bank and national treasury in the early days of the Philippines’ banking industry.

In 1852, the bank printed the country’s first paper money called “pesos fuertes”. Financing the development of the country, it financed the first railroad, the telephone network, electric utilities and steamship service. Having seen the tumultuous period of global wars and rebuilding in the process, BPI learned the importance of prudence and taking ownership for the long-term viability and sustainability of its efforts. It lived through many crises and learned first-hand the need to manage risks in various forms including external political, economic and geographic in nature.

Prudent management is the attitude of a business owner with a long-term focus. This had served the bank well through the ups and downs of the country’s economic and political cycles particularly in this pandemic. As of June 2021, BPI’s non-performing loans (NPL) ratio at 2.9% is lower than the industry’s 4.6% and its capital adequacy ratio is at 16.87%, well-above regulatory requirement.

Innovation

For a heavily regulated industry, the ability to innovate can be quite challenging. More often than not, these types of organizations will be built on rules, policies, guidelines, parameters, and requirements.

There is more clarity on the “do’s and don’ts” rather than “what-ifs and what-abouts”. Creativity and innovation may be suppressed – unintentionally, a consequence of a culture of obedience. Yet, BPI has been able to operate outside the box and re-think processes, re-engineer products and re-imagine banking… again and again.

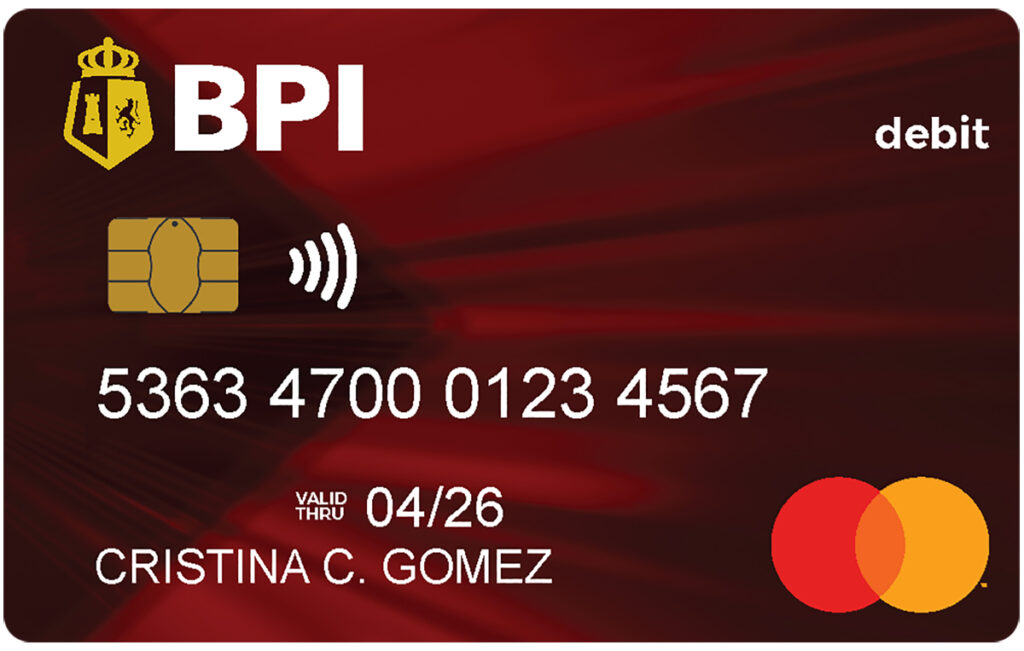

Long before the advent of disruptive innovation, BPI has been the first to disrupt itself time after time. In the 1980s, it introduced the automated teller machine, challenging its traditional model of over-the-counter banking transactions. It launched the BPI Express Teller card offering the convenience of not just withdrawing in the ATM but also paying in stores, something a passbook cannot do. In the 1990s, it offered phone banking enabling 24/hour account servicing which was followed soon by online banking then mobile banking.

In the 2000s, BPI replaced its magnetic striped cards with the more secure chip-based cards with real time rewards. In the last 5 years, BPI embarked on a major digital transformation enabling it to continue servicing customers in the midst of the pandemic even from their homes.

BPI Mobile app became the most downloaded banking app as it offered the convenience of funds transfers to anyone, bills payment, online shopping enhanced by security capabilities provided by QR code enabled transfers and OTP (one time pin) authenticated transactions. Now, customers can open deposit accounts conveniently, digitally, without leaving their homes, in a matter of minutes.

Real innovation makes life easier. This, BPI has been doing for 170 years through banking innovations that have made a difference in the day-to-day lives of Filipinos.

Timeless purpose

What drives BPI 170 years ago continues to drive BPI today – building a better Philippines, one family, one community at a time.

It has enabled dreams of many Filipino families come true such as owning one’s dream home and driving one’s dream car through its consumer bank, BPI Family Savings Bank while providing peace of mind with its life and non-life insurance products through BPI AIA (formerly BPLAC) and BPI MS joint ventures.

It has supported the dreams of micro, small and medium entrepreneurs through its Business Banking Group and microfinance subsidiary, BanKo.

Through its Corporate Banking Group, it has enabled companies to expand and create more jobs and connected more than 7,100 islands and over 100 million Filipinos by funding companies that support the development of the country’s infrastructure.

In fact, in the mid-1980s, BPI established Expressnet, the first network that enabled member banks’ ATMs and debit cards to be interoperable in ATMs and point-of-sale terminals.

This broad perspective towards business is rooted on the belief that when we focus on the needs of customers, everyone wins, the country wins. With G.R.I.T., we build a better Philippines for our fellow Filipinos.