While the combined wealth of tycoons on the 2021 Forbes Hong Kong Rich List rose7.5%to US$331 billion, up from $308 billion last year, more than half saw a pandemic-induced drop in their net worth. The complete list can be found at www.forbes.com/hongkong as well as in the February/March issue of Forbes Asia.

Hong Kong’s economy contracted 6.1% in 2020, its worst performance since 1998 during the Asian financial crisis. Stock market gains provided some reprieve as the benchmark Hang Seng index was up 5% since fortunes were last measured 13 months ago.

Li Ka-shing reclaimed his prime position as Hong Kong’s richest this year, due to a 20% jump in his fortune to $35.4 billion. While the share price of his property developer CK Asset Holdings was down 27%, Li benefited from his stake in the U.S.-listed video conference provider Zoom.

Property tycoon Lee Shau Kee, who surpassed Li last year by a slim lead, saw his wealth remain relatively unchanged and ranks at No. 2 with $30.5 billion. Henry Cheng and family added $1.4 billion to their net worth of $22.1 billion, retaining the third spot on the list.

This year’s biggest dollar gainers by far were husband and wife Yeung Kin-man and Lam Wai-ying, who benefited from the soaring demand for smartphone glass covers made by their company Biel Crystal. The duo more than doubled their wealth to $18.6 billion and jumped six spots to No. 4.

Wong Man Li (No. 14, $6.3 billion) of furniture maker Man Wah Holdings, was this year’s biggest gainer in percentage terms. His net wealth was up 200%, as demand in China for the company’s products boosted annual revenue by 19% to $857 million for the year ended September 2020.

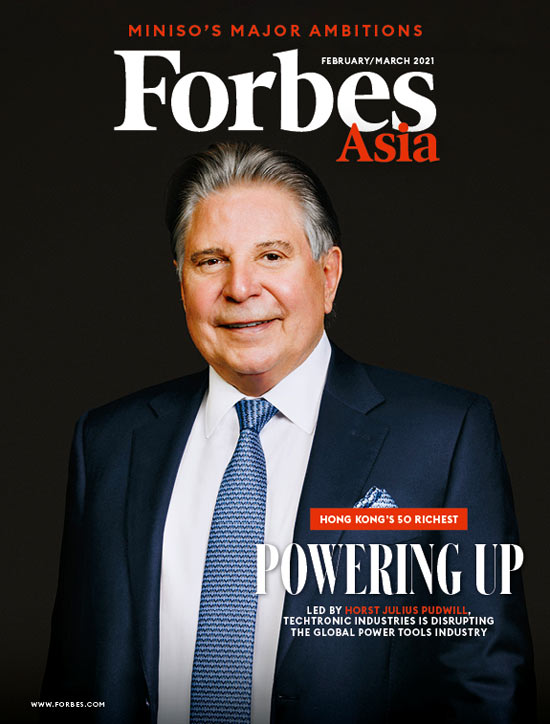

Horst Julius Pudwill (No. 12, $6.7 billion), whose net wealth was up 81%, is featured on the cover of the latest issue of Forbes Asia. Shares in his Techtronic Industries jumped on booming sales of power tools and floorcare products.

More than half of the 27 listees who saw their fortunes decline this year were property tycoons, as the real estate sector was hit hard by the pandemic. Peter Woo (No. 7, $17 billion), who took his Wheelock & Co private last June, bucked that trend. His wealth was up 47%, as the company saw a 52% surge in value after ending its 57-year run as a listed company.

The fortunes of other property magnates took a hit, including Joseph Lau (No. 8, $13.5 billion) of Chinese Estates Holdings, Tang Shing-bor (No. 19, $4.75 billion) of Stan Group, Pan Sutong (No. 41, $1.8 billion) of Goldin Properties, Vincent Lo (No. 42, $1.75 billion) of Shui On Landand Vivien Chen (No. 48, $1.25 billion)of Nan Fung Group. Lau’s brother Thomas Lau, who derives much of his wealth from malls and real estate, dropped off the list altogether.

This year’s ranking saw just one returnee –Goodwin Gaw, founder of private equity firm Gaw Capital Partners, who appears at No. 44 with $1.6 billion.

The minimum amount required to make the list was $1billion,downfrom $1.2billion last year.

The top 10 richest in Hong Kong are:

1) Li Ka-shing; US$35.4 billion

2) Lee Shau Kee; $30.5billion

3 )Henry Cheng & Family; $22.1 billion

4) Yeung Kin-man & Lam Wai-ying; $18.6billion

5) Lui Che Woo; $17.8 billion

6 )Lee Man Tat; $17.4billion

7) Peter Woo; $17billion

8) Joseph Lau; $13.5 billion

9) Kwong Siu-hing; $13.4 billion

10) Joseph Tsai; $12.5 billion

The list was compiled using information from analysts, government agencies, individuals, stock exchanges, various databases and other sources. Net worths were based on stock prices and exchange rates as of the close of markets on Feb. 5 and real-time net worths on Forbes.com may reflect different valuations. Private companies were valued by using financial ratios and other comparisons with similar companies that are publicly traded. The estimates include a spouse’s wealth and, where the person is the company founder, also include the wealth of sons, daughters and siblings that is derived from that company.

For more information, visit www.forbes.com/hongkong