Must we always attach value to everything? Rightly or wrongly, we measure just about anything — from vital statistics to school grades to number of steps made per day and now to number of friends, number of views, comments, shares, likes, hearts, stars, thumbs up and thumbs down. Self-valuation has taken on a level of intensity unseen in the past as social media enabled people to measure how others perceive them or their posts on a real-time basis.

Banks use a different set of metrics when evaluating loan applications. When applying for a loan, there is much at stake for both the client and the bank. It is an investment involving not just Treasure, but more importantly, Time and Trust.

Amid the pandemic, loans are quite the hot topic. Many businesses (and individuals) have turned to banks to get additional financing to help them adapt to the requirements of the new normal or to tide them over until things normalize. However, as some of them have found, securing loan approvals in this economic climate is no walk in the park.

To shed some light on how bankers typically evaluate applications, I’d like to share some basic accounting principles.

Book Values. Accountants are trained to “balance the books.” The amounts recorded on the balance sheet as assets, liabilities, and equity are book values — literally and figuratively. When a company applies for a loan, one of the requirements is the submission of audited financial statements to provide the bank insights on the business, which include:

∆ Sustainability of the Business Model. One of the ways banks evaluate this is the demand for and viability of one’s products or services. In this pandemic, the question of business model is one of extreme importance. Are their products and services essential? If a business used to operate under face-to-face, high-touch conditions, can it remain viable amid physical distancing and cordons sanitaires? Can the business pivot to continue to generate and satisfy demand from the safety of its customers’ homes?

∆ Liquidity through management of cash and working capital. Quick ratio and current ratio assess a company’s ability to service its operational obligations by looking at its cash and liquid assets vis-a-vis its current liabilities such as accounts payables.

∆ Solvency, or viewed another way, Leverage vs. Skin-in-the-Game. You can tell the level of commitment of an owner to the business by looking at the amount of capital invested. If they are betting a significant amount of their own money in the business, then they will make sure it succeeds and will not just jump ship at the onset of trouble. One can also compare the amount of debt vis-a-vis the equity, measured by the debt-to-equity ratio. Banks compute a debt-service ratio to determine if a business can continue to pay for its regular debt obligations with its operating income. When solvency ratios don’t improve, business continuity becomes a real concern.

Appraised Values. When one needs a loan, offering collateral is one way to save on interest costs. This is what you call a secured loan. Secured loans assure the bank that you are willing to put up something valuable and indicates your commitment to servicing your debt obligation. I’ve been asked why interest rates of banks vary. This is because a bank’s loan interest rates consider three types of costs.

– Cost of Deposits and Funds. This includes the amount of interest paid by banks to their depositors and creditors, which are sources of loan funding.

– Cost of Operations. This covers the administrative, servicing, and manpower costs such as processing, evaluating, monitoring, and renewing the loan through different channels.

– Cost of Credit – Secured vs. Unsecured. This takes into account the risks of collection, recovery, and default. This is why interest rates on secured loans are lower than unsecured loans. When a client offers collateral to save on interest cost, the bank will appraise the value of the property, taking into consideration:

• Transfer Fees, Taxes, and Brokers’ Commissions that need to be deducted from the selling price of a property.

• Property-specific characteristics. Appraisers go and visit the property itself to assess a property’s condition. They look at whether the property is irregular-shaped, has right-of-way issues, or is in a hazard-prone area. There is a very helpful website called HazardHunterPH developed by GeoRisk Philippines, a multi-agency initiative led by Phivolcs and funded by DOST, that allows you to find out if your property is prone to different kinds of hazards (i.e., seismic, volcanic, hydrometeorological) for free. Check it out and input your property’s address.

Personal Values. Beyond book values and appraised values, one’s personal values are important considerations for the bank. This is why the bank interviews its clients and conducts background checks. We find out how the client manages his business on a daily basis, whether he has a succession plan and if there are professional managers involved. We check employee welfare and retention, as well as company financial management practices. We also look into clients’ personal finances, particularly whether they pay credit cards, housing loans, or car loans on time. When applying for a loan, banks access credit reports available through credit bureaus such as the government’s Credit Information Corporate (CIC) or private bureaus. Thus, one must strive to maintain good credit standing by living within one’s means. Knowing one’s cash inflows and religiously setting aside programmed obligations and a portion for savings show leadership, financial stewardship, and discipline.

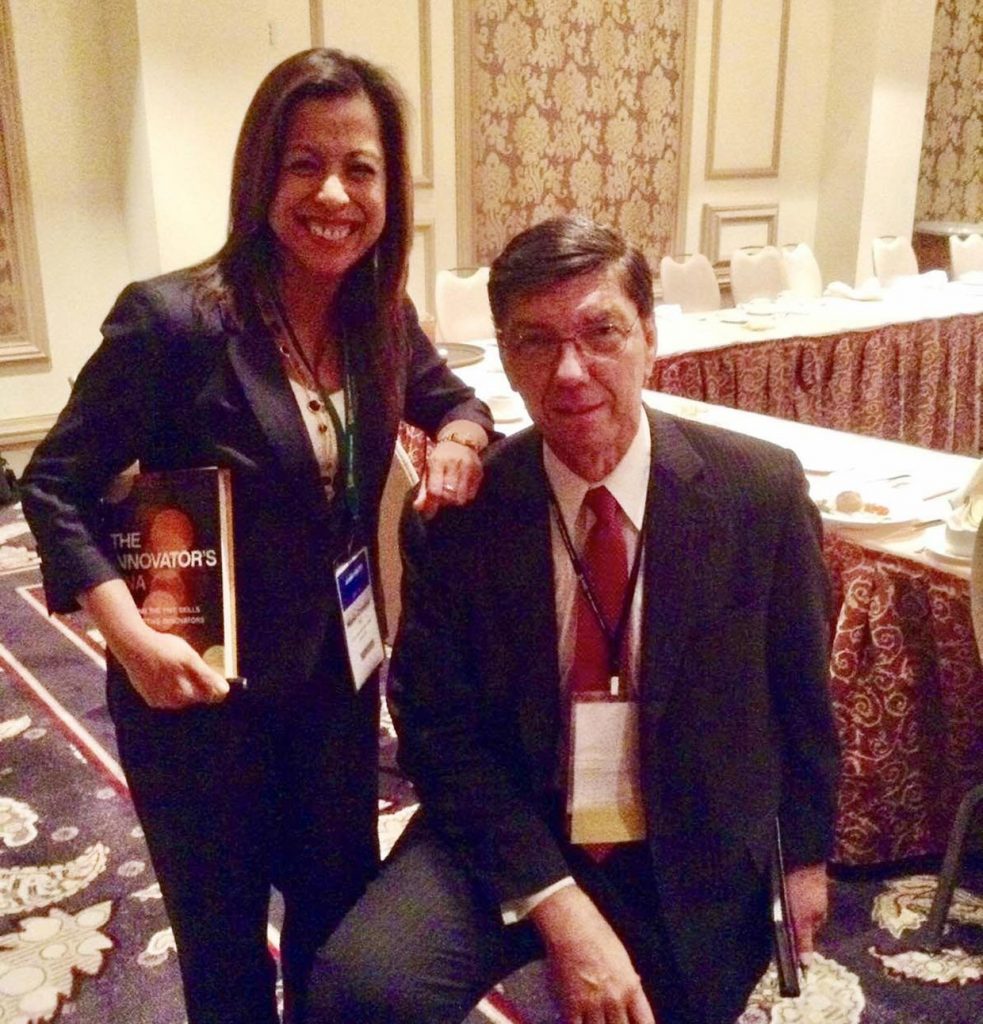

Allow me to leave you with this thought from one of the best (my favorite) thinkers of all time who passed away early this year — Harvard Business School Prof. Clayton Christensen, author of The Innovator’s Dilemma, where he introduced the theory of Disruptive Innovation. For me, his greatest legacy is his book How Do You Measure Your Life. He left us with this thought: “Be careful in how you measure success. God doesn’t employ accountants. He doesn’t need to count because He has an infinite mind. He doesn’t aggregate to get a sense of wealth. He will not ask how much money I (you) made or left in the bank. Instead, He will say, “Can we talk about those individual people whose lives you helped become better, whose lives you blessed because you used the talents I gave you to help them?” I have had the pleasure of personally meeting him in one of the SAS conferences I attended. These photos show what a down-to-earth, sensitive man he was, realizing I was going to strain my neck looking at him. For a big-time professor, he sat down for me for a cherished photo.