The take-up for leisure-oriented residential projects outside Metro Manila remains robust. This strong demand is partly driven by growing appetite for greener and more open spaces, as well as rising take-up for resort-themed developments outside of Metro Manila, mainly driven by an affluent investor market.

As I previously discussed, the growing popularity of these developments is also facilitated by an improving road network from Metro Manila to the South Luzon provinces of Cavite, Laguna, and Batangas. This improving road network promises land and property price appreciation, making condominiums, House & Lot (H&L), and Lot-only units in South Luzon—especially Batangas—attractive among Overseas Filipino Workers (OFW) households and the local employees-driven end-user market.

Vertical remains integral

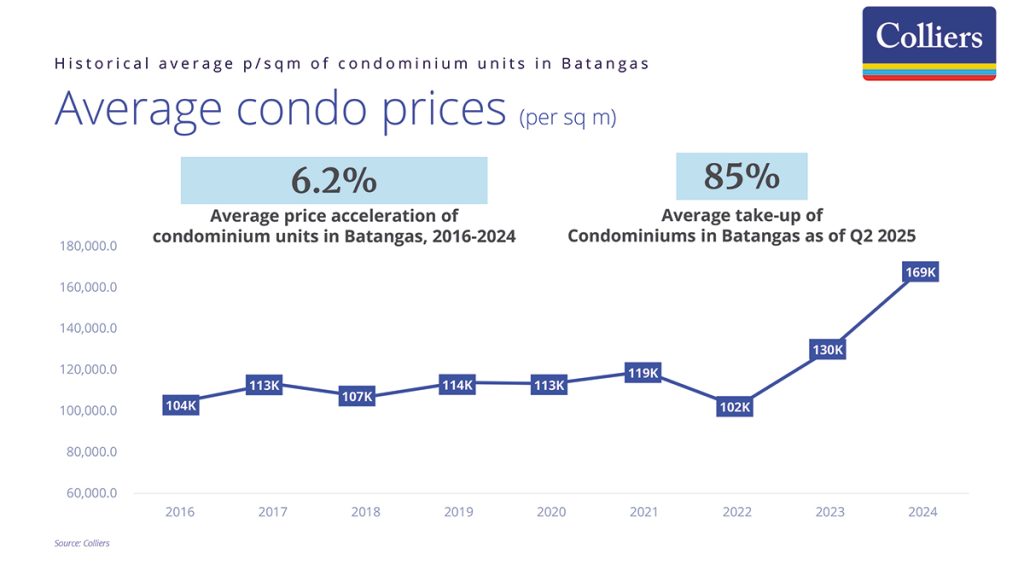

What has become evident is that while a number of condominium projects in certain areas in Metro Manila fringes continue to post sluggish sales velocities, projects launched by national developers in South Luzon, including those in Batangas, have been recording strong take-up so far.

For example, condotel developments priced between PHP213,000 and PHP316,000 per sq meter or about PHP7 million to PHP17 million per unit posted take-up of between 60% and 100% as of Q2 2025. This means that launching a good product (e.g. condotel) in an ideal location that features premium amenities is a must these days.

Horizontal proves to be pivotal

For Batangas’ H&L market, economic projects (PHP580,000 to PHP2.5 million) are well-received by local end-users, especially for projects located in the municipalities of Tanauan, Sto. Tomas, Nasugbu, as well as Lipa City. The more expensive projects (priced between PHP10 million and PHP40 million) are already 87 to 100 percent sold. Average take-up of H&L projects in Batangas is 88 percent as of Q2 2025, one of the strongest in key horizontal hubs in Luzon.

Meanwhile, take-up for lot-only units in Batangas is driven by the upscale to luxury segments (PHP2.7 million and above), particularly for projects in Calatagan and Lipa City. Average take-up of lot-only units in Batangas is 89 percent, priced at an average of PHP20,600 per sq meter as of Q2 2025. The high-end segment, starting at PHP30,000 to PHP50,000 per sq meter, recorded an average take-up of 77 percent as of Q2 2025.

Industrial promotes residential

Batangas has always been on the radar of property developers looking for industrial parks to develop, as well as manufacturers and third-party logistics firms looking for industrial land to lease and modern warehouses to occupy.

At present, among the manufacturing locators in Batangas are firms involved in the manufacture and export of electronics, semiconductors, food, and other high-value products, driving Batangas’ viability as a manufacturing hub. Colliers sees Batangas’ viability as a manufacturing site, driving interest for leisure-themed developments, especially among expatriates, local executives of large Filipino manufacturing locators, as well as foreign tourists.

Booming economy meets improving connectivity

Data from the Philippine Statistics Authority (PSA) showed that South Luzon’s economy grew by 5.6 percent in 2024, almost at par with the national growth of 5.7 percent. It is also the second largest contributor to the national economic output, next to the National Capital Region (NCR).

The steady inflow of remittances also ensures a stable demand for residential end-use. It helps that South Luzon covered close to a fifth of deployed Filipinos for overseas employment in 2023 according to the latest data from PSA. This only proves that Batangas is an ideal residential market for remittance-receiving households acquiring residential units for end use.

Batangas already benefits from improved connectivity to Metro Manila due to existing expressways in Cavite and Laguna. But this should further be enhanced by the completion of the North-South Commuter Railway, LRT-1 Cavite Extension, NLEx-SLEx Connector Road, Cavite-Laguna Expressway (CALAX), Subic-Clark-Manila-Batangas (SCMB) Railway, Bataan-Cavite Interlink Bridge, Cavite Bus Rapid Transit, Cavite-Batangas Expressway (CBEX), and the Nasugbu-Bauan Expressway (NBEX). These are game-changing projects that will help redefine Batangas’ property landscape.

Where to next?

With the Q3 2025 residential market data showing some upside, Colliers Philippines believes that property developers should continue exploring key areas outside of Metro Manila that are well-positioned for aggressive expansion and innovation.

What’s happening in Batangas right now is a clear test case of the Philippine property’s continuing differentiation and evolution. With sustained or even growing property demand across all sectors supported by dynamic regional growth and greater access to and from the country’s capital, expect more developments in Batangas that clearly signify property firms’ aggressive shift to suburbia!

#PropertyReportFeature

#FeaturedStory