The condominium slowdown in Metro Manila has been compelling developers to look for alternative hubs outside the capital region. In Visayas and Mindanao, localities such as Cebu, Bacolod, Iloilo, and Davao are already popular property investment destinations. But the shift to suburbia has been enticing developers to explore more viable locations for integrated communities that feature offices, condominiums, malls, hotels, and institutional or support facilities.

Cagayan de Oro’s property market has been attracting interest from national players. Colliers Philippines saw recent activities in the city’s office market, while national players are launching and building residential towers. Northern Mindanao is also being positioned as an exciting tourism corridor, and Cagayan de Oro leads the way in enticing foreign hotel brands to establish footprint in the region.

A rising BPO destination

As of end-H1 2025, Cagayan de Oro’s (CDO) office stock reached 54,000 sq meters, with SM, Limketkai Sons, Inc., Ayala Land, and Robinsons Land accounting for more than two-thirds of CDO’s total office supply. In 2024, Cagayan de Oro recorded 5,100 sq meters (54,900 sq feet) of office space transactions, down 62% from the 13,300 sq meters (143,500 sq feet) in 2023 due to limited office supply.

From 2023 to H1 2025, among the notable deals were spaces taken up by OfficePartners360, Ubiquity Global Services, Regus, and Xinyx Design Consultancy Services. These firms occupied spaces in SM City CDO Downtown Tower and Limketkai Module 2 Building. Other outsourcing firms that have established their presence in the province are Outsource Access, Teleperformance, Concentrix, SupportZebra, and Qualfon.

As of end-Q1 2025, vacancy in Cagayan de Oro reached 22.7%, the lowest since we started recording in Q2 2023. As of end-H1 2025, net take-up in Cagayan de Oro reached 1,900 sq meters (20,400 sq feet), up from the 800 sq meters (8,600 sq feet) of negative net take-up a year ago.

Improving infra to boost residential take-up

Colliers Philippines believes that Cagayan de Oro’s competitiveness as an investment hub makes the city one of the most ideal business locations in Mindanao. The city is also on the radar of outsourcing firms, making it an ideal location for residential end-use, especially for outsourcing employees as well as Overseas Filipino Workers (OFWs).

The Laguindingan Airport will also be expanded and modernized as it is being primed as another international gateway. Colliers believes that this should further entice national and homegrown property firms to launch more residential projects in the city.

The affordable to mid-income segments (PHP2.5 million to PHP12 million) are the most viable segments in CDO’s condominium market, accounting for more than 90% of total launches and take-up in the locale from 2024 to H1 2025. National players with existing condominium projects in CDO include SMDC, Ayala Land, Filinvest Land, Vista Land, Cebu Landmasters, and Pueblo de Oro.

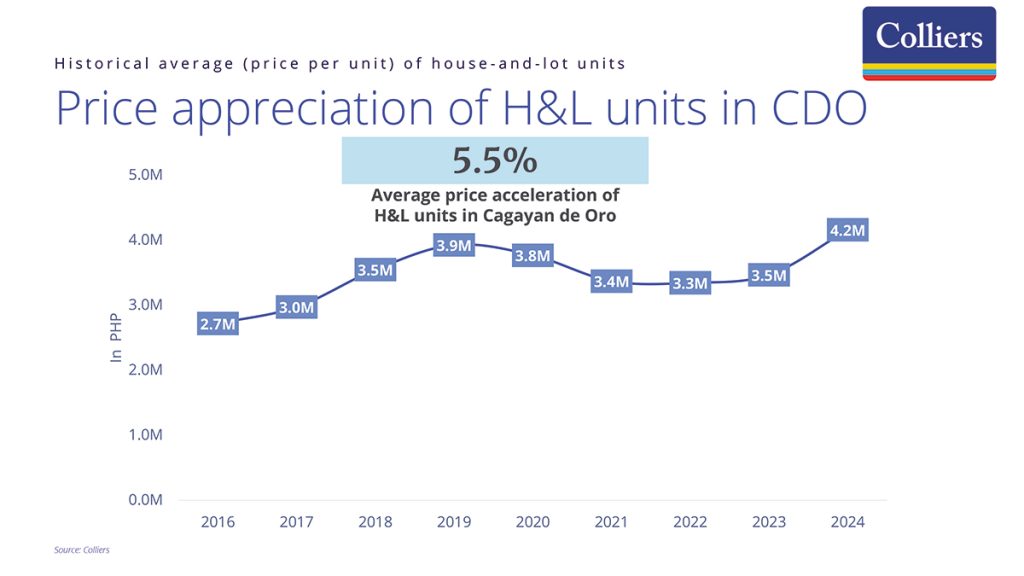

For CDO’s house-and-lot (H&L) market, the economic projects (PHP580,000 to PHP2.5 million) are well-received among local end-users, especially for projects located in the areas of Gran Europa Uptown, Lumbia, and Iponan. National and VisMin-based developers with house-and-lot projects are Ayala Land, Vista Land, Robinsons Land, Cebu Landmasters, Pueblo de Oro, Liberty Land, and Johndorf Ventures.

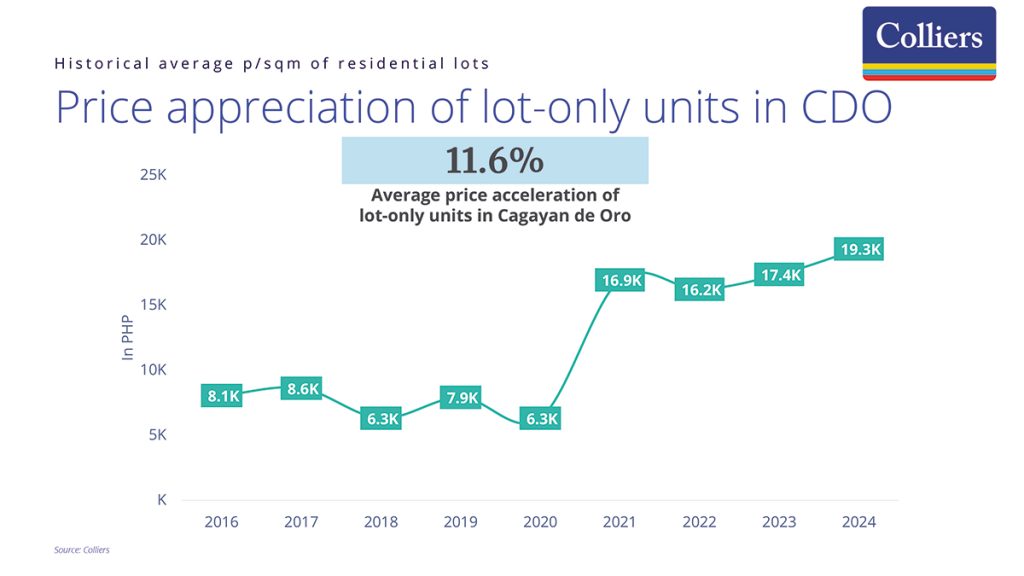

For the lot-only market, the luxury segment (PHP4 million and above) accounted for almost 99% of total take-up from 2024 to H1 2025. Supply of lot-only units is currently limited in CDO. Ayala Land, Robinsons Land, Pueblo de Oro, OB3 Realty, and A Brown Company are the only property firms with existing lot-only projects in the city.

A thriving leisure hub

From 2025 to 2029, Colliers expects the delivery of nearly 1,100 foreign-branded hotel rooms in Cagayan de Oro. The foreign brands that will be establishing presence in the city are Radisson Blu, Citadines, and Dusit Princess. Sheraton and Dusit Thani have also expressed interest in expanding in CDO.

Cagayan de Oro recorded average hotel occupancies of between 60% and 70% as of end-2024, already far from the 10%-25% occupancy in 2020 and 2021. In our view, CDO’s occupancy will likely be sustained due to the steady demand from domestic and business travelers.

#PropertyReportFeature

#FeaturedStory