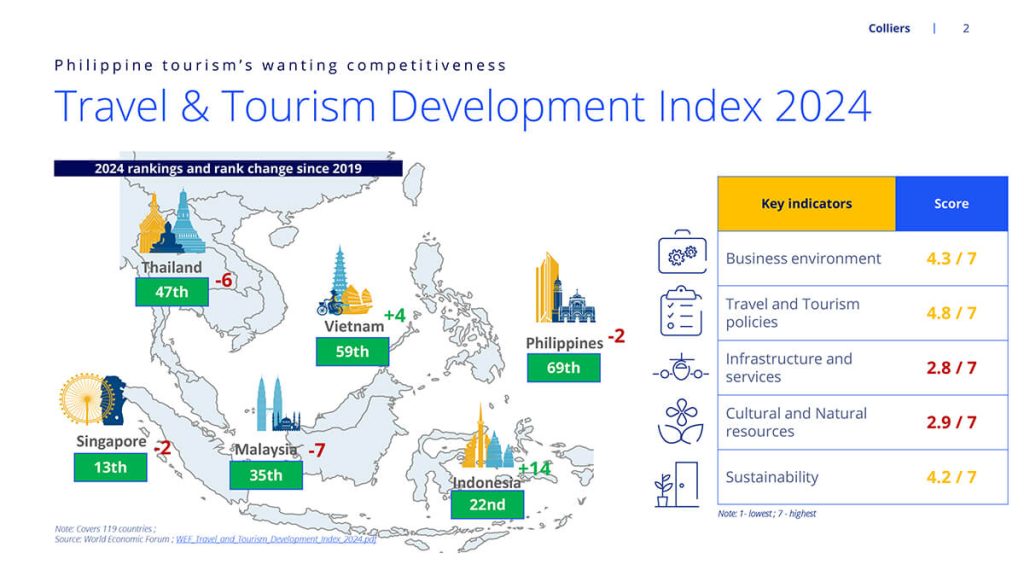

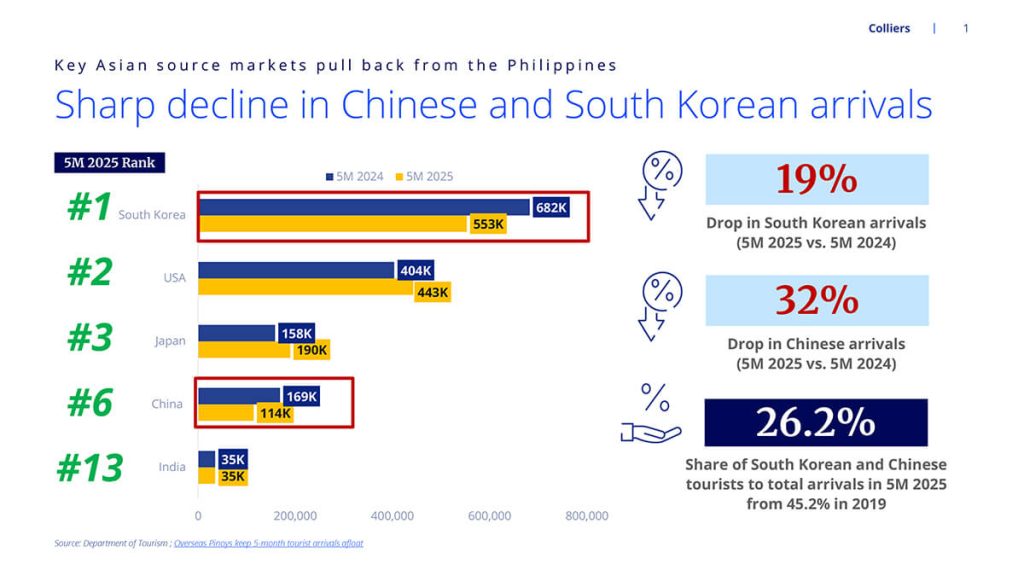

The Philippines continues to remain a laggard in Southeast Asia in terms of attracting international visitors. South Korean and Chinese arrivals are down, and the Philippine Tourism department is scrambling to look for other foreign markets.

With the Philippines paling in comparison to its peers in terms of foreign tourists as well as travel and tourism competitiveness, the country has one of the lowest foreign hotel brand penetration in the region. International hotel brands continue to look for expansion sites across the Philippines’ more than 7,600 islands, but infrastructure connectivity and a solid tourism branding are crucial in enticing billions of foreign investments into the country’s hospitality sector–two areas where the Philippines ranks disappointingly globally.

There is a strong case for the Philippine leisure sector to diversify its tourism markets and expand MICE facilities, especially now that conferences and business events continue to flourish. Colliers believes that the domestic market will likely help fill the void left by plummeting South Korean and Chinese tourists, so it’s pivotal for hotel operators and other leisure-related businesses to continue innovating to corner the local market’s expansion. These measures should pave the way for a more vibrant tourism sector moving forward.

Proactive differentiation

Property developers are heavily differentiating given the Philippine leisure sector’s evolution. Firms with leisure footprint are building hotels and condotels complemented by golf courses as well as scenic views. Hotel operators should prudently assess what the market requires and should add amenities that cater to the needs of business travelers, backpackers, and ‘staycationers’. We also see more hotel operators putting a premium on sustainability, and this is one trend that we see likely to be highlighted by developers in the years to come. Whether in the form of business and lifestyle amenities or top-notch concierge services, hotel operators should drum up their key offerings to stand out in the market. This is crucial, especially as we attempt to attract more business conventions and international sporting events, particularly in thriving MICE hubs outside Metro Manila such as Clark, Cebu, Iloilo, Davao, Cagayan de Oro, and Bulacan.

Diversification of source markets

Related to forging strong public-private initiatives in the leisure sector is the hotel players’ goal to attract more foreign tourists, aside from our traditional markets such as South Korea, Japan, and Taiwan. Hotel players should closely follow the new foreign markets that the Tourism department is trying to pursue, including India, Qatar, Israel, and Cambodia. Hotel operators should also work with airlines that have mounted direct flights to Manila such as Air France, Air Canada, and Air India. These are source markets that could potentially help fill the void left by plummeting arrivals from South Korea and China.

Complement hotels with MICE facilities

We see several in-person events driving demand for meetings, incentives, conferences, and exhibition (MICE) facilities. Colliers believes that these networking and special events will continue to propel demand for MICE facilities, especially in MICE hubs such as Clark in Pampanga, Cebu, Davao, and Iloilo. Property firms should keep this demand driver in mind whenever they build their own accommodation facilities or bring in foreign partners.

Foreign arrivals behind target

Data from the Department of Tourism (DOT) revealed that foreign arrivals reached 2.54 million as of 5M 2025, down 1.2% from the 2.57 million a year ago. Given the current pace, we are again unlikely to breach even the 7.7 million arrivals set by the Philippine government in 2024. Tourists from South Korea continue to drop, which is attributed to the depreciation of the Korean Won, political and economic uncertainties, and crimes involving South Korean nationals in Metro Manila.

Despite lackluster arrival figures, the Tourism department reported that the share of tourism to the country’s economy rose to 8.9% in 2024 from 8.7% in 2023. Domestic tourism expenditure also grew by 16.4% from PHP2.7 trillion (USD48 billion) to PHP3.1 trillion (USD55 billion). Tourists are also spending more and staying longer, with the Philippines being the highest ranked in Southeast Asia in terms of average expenditure per arrival and length of stay.

To be continued.

For feedback, please email [email protected]

#PropertyReportFeature

#FeaturedStory