Property Report attended the recent Q1 2025 Market Briefing by Leechiu Property Consultants (LPC), where the group’s directors shared insights into both the office and residential sectors—highlighting opportunities amid evolving market conditions and potential global headwinds.

The Philippine property market entered 2025 on a promising note, signaling a strategic growth forward for developers, investors, and end-users alike. Amid ongoing geopolitical shifts and evolving U.S. tariff policies that continue to impact global capital markets, stakeholders are encouraged to stay observant and adapt to the fluid landscape.

Office sector: stabilizing and strengthening

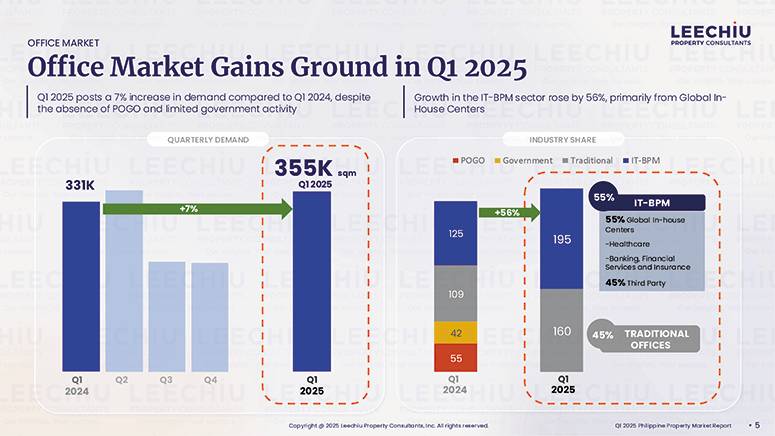

The office market showed encouraging signs of recovery, with a 7% year-on-year growth in demand, totaling 355,000 sqm of new leases in Q1 2025. This was achieved despite continued exits by Philippine Offshore Gaming Operators (POGOs) and minimal participation from government-related leases. The demand was primarily driven by the IT-Business Process Management (IT-BPM) sector—especially Global In-House Centers (GICs) in the healthcare and finance industries.

“The good news is that from 18%, we are now at 17%,” shared Mikko Barranda, Director of Commercial Leasing at LPC. “You may say it’s just a 1% drop, but 1% is equivalent to 100,000 to 120,000 sqm of space. So we are starting to head where vacancies are leveling off.”

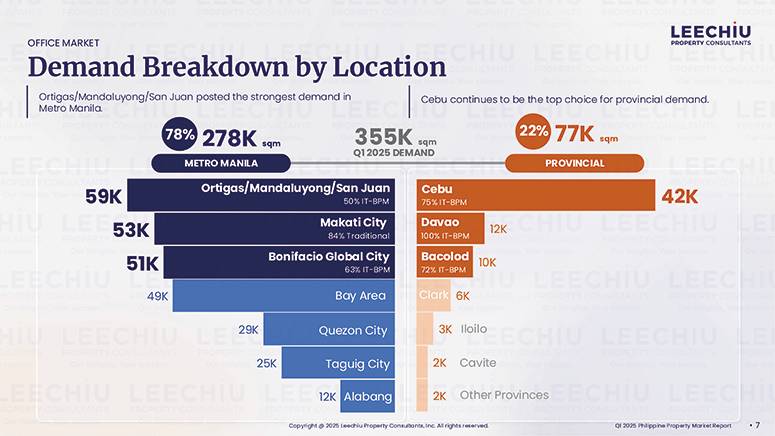

Ortigas-Mandaluyong-San Juan led Metro Manila in lease transactions with 59,000 sqm, while Bonifacio Global City had already absorbed 40% of its total 2024 demand in just the first quarter of this year. With space contractions slowing and vacancy rates improving, the industry looks forward to a projected net take-up of 490,000 sqm by year-end.

Barranda emphasized that despite some cautious sentiment, major developers continue to build and invest in the office sector. “They believe in the office sector. They believe in the property market—that it will continue on. Some developers have indeed pivoted by building more outside Metro Manila, but the larger players have not slowed down. The BPO sector and traditional offices are keeping us afloat. Hopefully, we can see continued growth in the next quarters.”

Residential sector: buyer caution meets developer adaptability

The residential market is showing signs of a moderate rebound, with a 14% increase in Metro Manila condominium demand during the first quarter of 2025. This momentum has been supported by recent policy rate cuts and a wave of developer promotions designed to attract more buyers. However, the volume of new project launches has slowed considerably—dropping 77% from the previous quarter—as developers focus on selling existing inventory, particularly in the mid-market segment.

Buyers are responding positively to flexible payment terms and promotional offers, especially in locations where properties offer both lifestyle and investment potential. This shift has prompted developers to double down on their marketing efforts and adopt more competitive strategies.

“We’ve seen a good start for the year for the residential market,” said Roy Golez, Director of Research and Consultancy at LPC. “But we need to move with caution for now due to very recent developments in the world capital markets. For developers, they will need to be more aggressive with their marketing: their promos, payment terms. For buyers, this will be a good time to research and take a deeper dive and look at the developer offerings. There might be a short window of opportunity to acquire property at favorable terms while supply is not yet at comfortable levels.”

Golez further emphasized the crucial role of overseas demand in sustaining the sector. “A big majority of our residential buyers are OFWs. Turbulence in the capital markets would impact their confidence levels. Hopefully, it will be short-lived,” he said.

Long-term thinking in an emerging market

In discussing investment sales and the broader market trajectory, Tam Angel, Director of Investment Sales at LPC, stressed the importance of perspective.

“We really need to look at the situation from a mid-to-long-term view,” Angel said. “Yes, we have a lot of headwinds—but there are also solutions and stimulants across each sector. We’re not an established market, we’re an emerging one. We have to build all these condos for the growing population. We can’t expect developers to just hold back; they’re also trying to battle it out for market share.”

Angel added that the challenges faced are “a natural progression for an emerging market, if not necessary.”

A measured path forward

Despite the shifting economic environment, LPC’s Q1 2025 Market Briefing reveals a clear theme: adaptability. Across sectors, the response to uncertainty has not been retreat, but rather strategic recalibration. Developers are shifting their locations, diversifying their offerings, and doubling down on demand-led strategies.

For office spaces, a slow but steady recovery driven by the IT-BPM sector provides the necessary momentum. In residential, favorable buyer conditions and the steady return of OFW remittances offer hope—provided market confidence remains intact.

Ultimately, the message from the ground is clear: the Philippine property market is still growing—but with caution, calculation, and a view toward long-term transformation.