Property Report attended the Full Year 2024 PH Property Market Report hosted by Leechiu Property Consultants (LPC). The event focused on the challenges and opportunities facing the residential property sector. As 2024 draws to a close, the market has demonstrated both resilience and a cautious outlook, presenting unique opportunities for buyers and developers to realign their strategies.

Opportunities amidst a sluggish residential market

The residential property market in Metro Manila experienced a significant slowdown in 2024. Sales take-up for the first eleven months dropped 63% compared to full-year 2023, and new project launches fell to approximately half of last year’s volume. While these figures underscore the market’s cautious state, they also present an opportune moment for buyers.

“As developers recalibrate their selling strategies, this might provide an opportunity for buyers waiting on the sidelines to enter the market and invest in residential properties,” said Roy Golez, LPC’s Director of Research and Consultancy.

Developers have begun enhancing inventory with features like rent-to-own schemes, fully furnished units, wellness-centric designs, and exclusive memberships. These adjustments aim to capture the attention of potential buyers, setting the stage for market recovery in 2025.

Regional growth outside Metro Manila: Driving the residential market

Residential development outside Metro Manila remains a key focus area for the Philippine real estate market, driven by increasing demand for house-and-lot properties. LPC’s Director of Research and Consultancy, Roy Golez, emphasized, “Outside of Metro Manila, the focus really are the house and lots being developed by developers.”

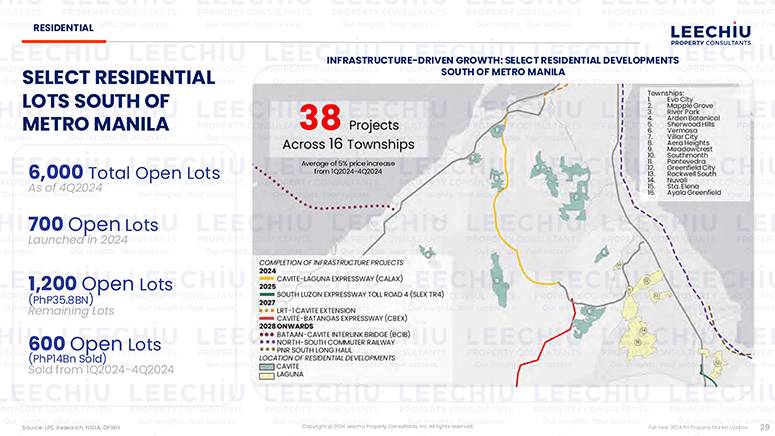

Key regions such as Cavite, Laguna, and Bulacan are thriving due to enhanced accessibility from major infrastructure projects. The completion of the Cavite-Laguna Expressway (CALAX) in 2024 and the anticipated completion of the South Luzon Expressway Toll Road 4 (SLEX TR4) in 2025 are set to further boost demand for residential developments in these areas. With 38 projects spread across 16 townships, these regional hubs represent a significant shift in residential market preferences toward more spacious and accessible living options.

While affordable housing in the PHP 1.8 to 4 million range is showing potential growth, it remains a smaller, underserved segment. Golez noted, “The 1.8 to 4 million market saw growth, but it was done from a very low base. This is just from October to November 2024.” Although this market segment experienced over 100% growth during this period, Golez remarked, “A 100% growth from a low base is still low.” Developers are expected to recognize the growing demand in this segment in the coming quarters, adding diversity to the housing options available outside Metro Manila.

Overall, regional growth continues to be the driving force of the residential market, with infrastructure advancements making house-and-lot developments increasingly attractive for buyers seeking affordability and accessibility. This shift toward regional hubs reflects the evolving preferences of Filipino homeowners in pursuit of the “Filipino dream” of owning a house and lot.

A buyer’s market in 2025

For buyers, the current market offers a strategic opportunity to secure properties under favorable conditions. Developers are implementing buyer-friendly measures, including rent-to-own options, extended payment terms, and discounts. Wellness-focused designs and fully furnished units are also becoming standard, adding significant value to residential offerings.

The market slowdown has also expanded the inventory of residential lots, with 6,000 open lots recorded by the fourth quarter of 2024. Of these, 700 were launched in 2024, and 600 were sold, indicating sustained interest even in a cautious market.

The residential market in 2024 showcased a delicate balance of challenges and opportunities. Developers, buyers, and financial institutions have used this period to reassess and adapt. The combination of resilient economic fundamentals, regional infrastructure growth, and evolving developer strategies positions the market for recovery in 2025. With a focus on more housing options and regional development, the Philippine residential sector is poised to turn its 2024 challenges into opportunities for sustainable growth.

Key insights from LPC’s 2024 market report

Strong demand drivers, but sales lag

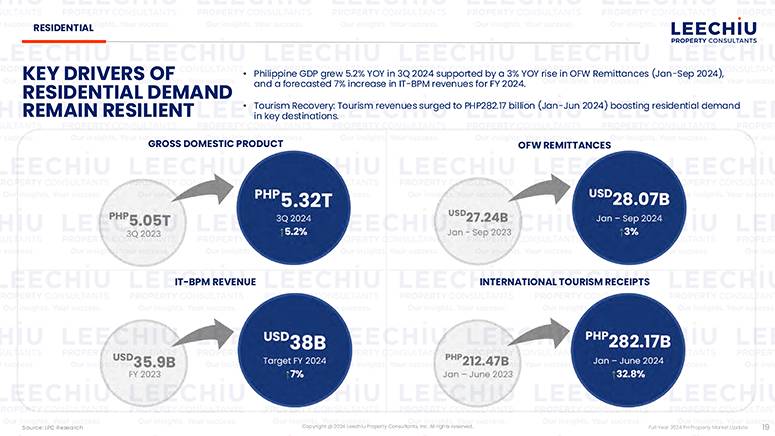

Despite steady economic drivers—such as a 5.2% GDP growth in Q3 2024, a 3% rise in OFW remittances (USD 28.07 billion by September 2024), and a 32.8% surge in tourism revenues in the first half of 2024—condominium sales remain subdued. Sales in Metro Manila accounted for only 63% of 2023’s volume, signaling that demand alone has not translated into transactions.

Cautious new launches and stable rentals

Developers took a conservative approach in 2024, with new project launches reaching only half of 2023’s count. Rental yields in prime locations like Bonifacio Global City (BGC) and Makati also showed minimal changes, reflecting a stable but unspectacular leasing market.

Regional leaders and sales activity

Quezon City led the way in residential condominium take-up across all market segments, followed by Pasig and Manila. Its large inventory and established appeal helped it remain at the top, while Ortigas Center (Pasig) and Manila maintained strong positions.

Improved loan conditions

Nonperforming residential real estate loans (RRELs) declined in 2024, reversing pandemic-era trends. Financial institutions’ stricter buyer screening processes contributed to this improvement, signaling healthier lending practices in the residential market.