Colliers Philippines continues to see a lackluster Metro Manila pre-selling condominium market. With sizable number of unsold condominium units in the capital region, developers are launching less while testing the demand for leisure-oriented developments in growth areas outside Metro Manila.

Colliers Philippines sees opportunities amidst uncertainties in the market. We highlighted these during the our Q3 Property Market Briefing on October 29. Despite tepid demand in the Metro Manila pre-selling condominium sector, we are

As of Q3 2024, Colliers data showed that remaining inventory in Metro Manila reached 75,300 units. It will take about 5.8 years to fully sell out all these unsold condominium units, nearly five times compared to the pre-pandemic period from 2017 to 2019 where remaining inventory life ranged between 0.9 and 1.1 years.

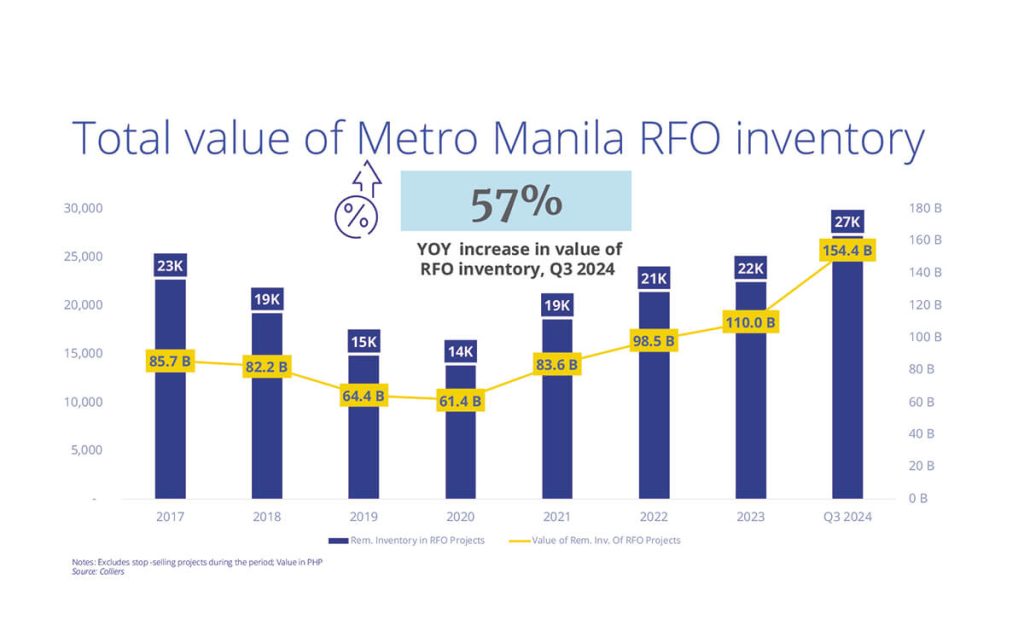

Of the 75,300 remaining inventory, 27,200 are ready-for-occupancy (RFO) valued at PHP154.4 billion. The lower to upper mid-income segments (PHP3.6 million to PHP12 million a unit) accounted for 57% of remaining RFO inventory in Metro Manila as of Q3 2024. Meanwhile, among the submarkets with high level of unsold RFO units include Pasig City, QC-South, Parañaque, Manila North, Makati Fringe, and QC-North.

Colliers recorded the launch of 8,000 units in the Metro Manila pre-selling market in 9M 2024, down 61% YOY. Meanwhile, only about 9,300 pre-selling units were sold during the period, down 53% YOY.

Continued expansion of vertical and horizontal footprint ex-Metro Manila

To offset the tepid demand in Metro Manila, Colliers continues to see the launch of new projects in high growth regions, including cities and provinces in CALABARZON, Central Luzon, Central Visayas, Western Visayas, Northern Mindanao and Davao region. From 2021 to 2023, we recorded an average growth of between 30% to an astounding 3,000% condominium launches in select provinces in these regions, with take-up growing from 17% to 600%. Horizontal projects (H&L and lot-only), meanwhile, recorded a growth of between 15% and 138% in launches, and take-up growing from 3% to 60% in 2023 compared to 2021.

Results from our previous surveys show that provinces in these areas are among the most preferred by respondents for their next residential investment. These regions are also among the major recipients of remittances from Filipinos working abroad, covering more than half of the 2.16 million deployed Filipino workers in 2023 and this should partly support the stable demand for residential end-use. Additionally, data from the Philippine central bank showed that these regions also accounted for nearly 66% of total real estate loans granted by Philippine banks in Q2 2024.

Rising popularity of leisure-oriented developments

Developers should take advantage of the thriving demand for resort or leisure-oriented properties outside Metro Manila. Among the property firms that already offer leisure-themed residential projects outside Metro Manila include Brittany, DMCI, Rockwell, Megaworld, Ayala Land, Robinsons Land, Cebu Landmasters and Damosa Land with projects located in Cebu, Davao, Bohol, Palawan, Boracay, Cavite and Batangas. As of Q2 2024, these developers’ projects are priced between PHP175,000 and PHP590,000 per sq metre with take up rates ranging between 43% and 100%.

Some developers are not only launching standalone residential developments but also leisure-themed integrated communities as well as condotels. Recently, Megaworld announced the launch of Ilocandia Coastown, a beachside township in Ilocos Norte. It will also be developing Lialto, a beachside golf estate in Batangas. Other developments in the pipeline include: Ayala Land’s Arillo— a mountainside estate in Batangas; Brittany’s Bern Baguio— a mountainside condominium in Benguet; DMCI’s Moncello Crest— a condotel in Baguio; and AppleOne Group’s JW Marriott Residences Panglao— a beachfront condotel in Bohol.

What’s notable is that some of these projects are even more expensive than Metro Manila developments but they continue to perform well. As I always stress in my briefings, these leisure-centric projects will likely benefit from a bustling travel and tourism sector.

So it’s not all headwinds for the Philippine residential market. We continue to see the shift to suburbia – developers banking on growth in areas outside the national capital region and the sustained growth of the Philippine economy. With more master planned communities being developed near public projects, Colliers is projecting faster price acceleration for these newly-launched projects.

For feedback, please email [email protected]